Wednesday 27 November 2024

- Company news

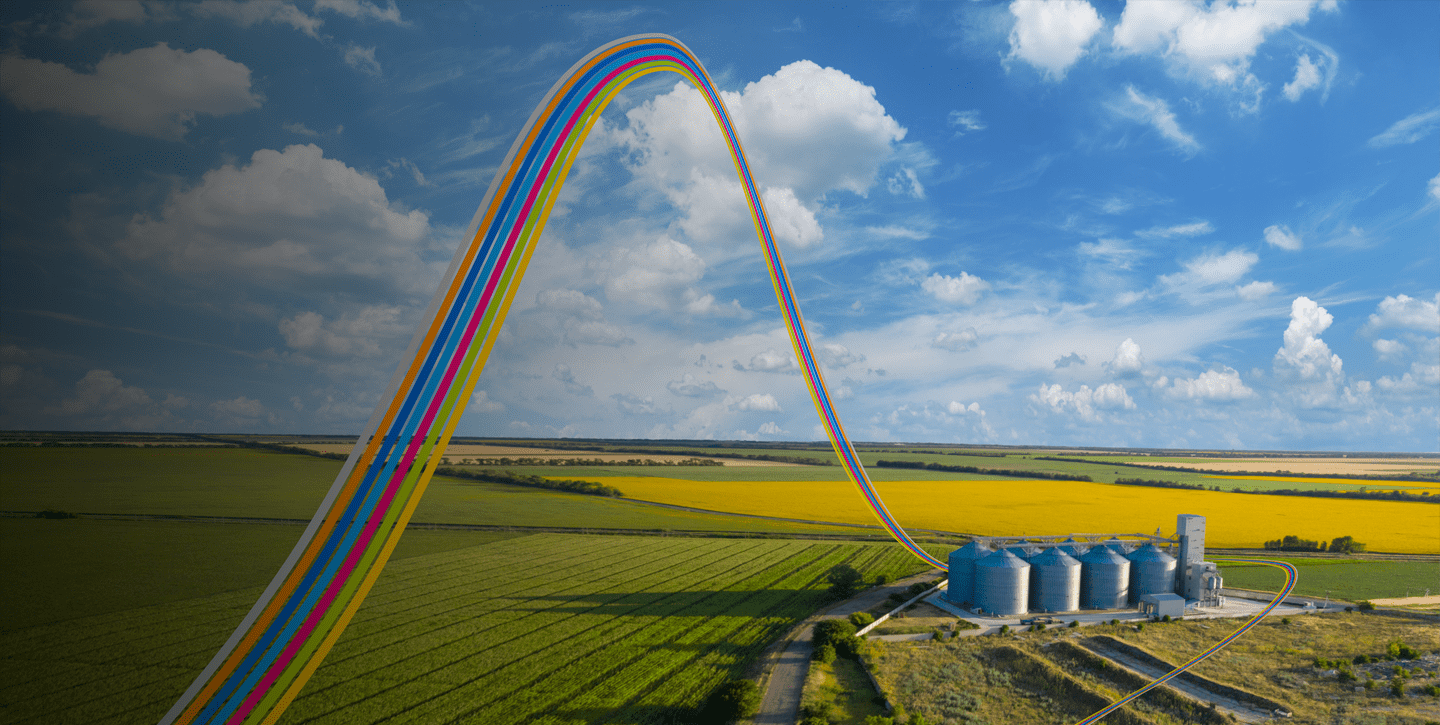

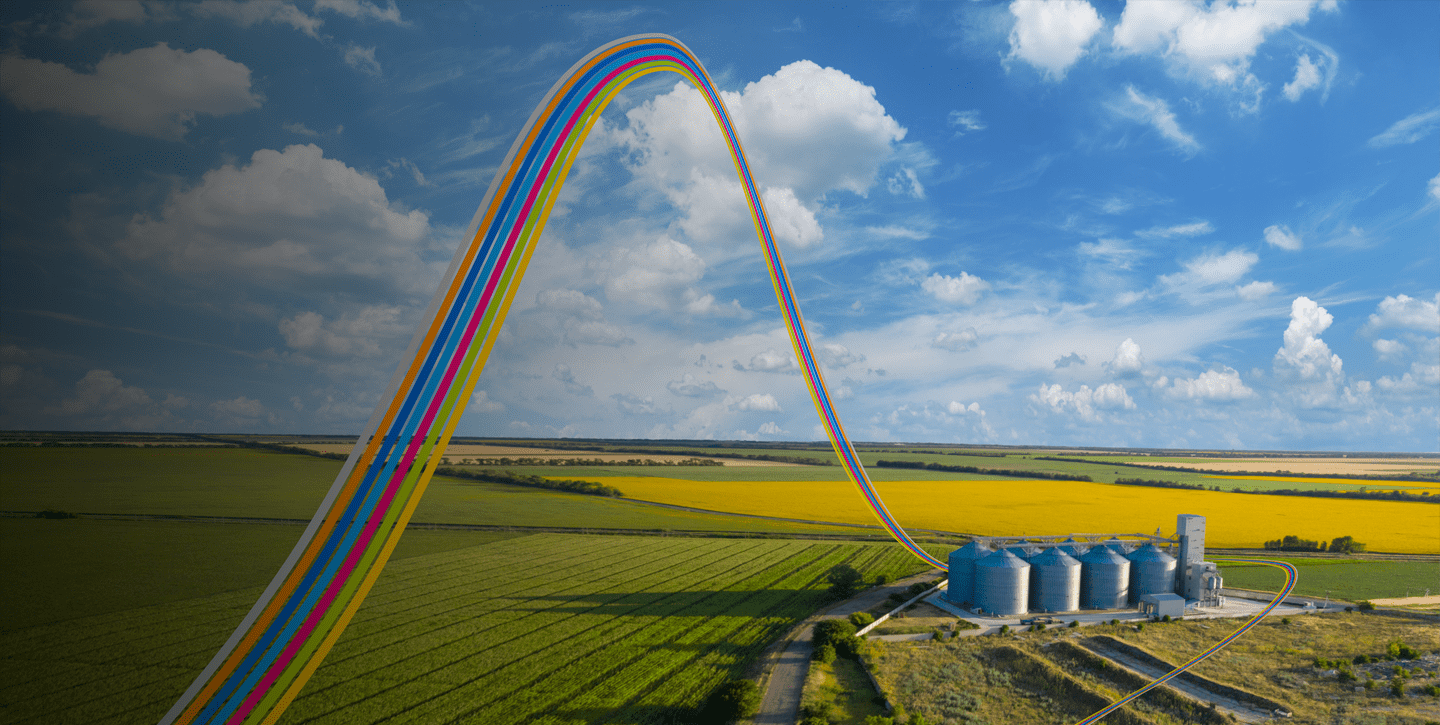

50 Years of Agriculture at TMHCC

With a country the size of the US, it is unsurprising that it is one of the world’s largest

agriculture traders. Across 800 million acres of land, nearly 2 million farms, from the local family-run homesteads to larger corporate entities, the US is a farming powerhouse.

As celebrated in numerous Hollywood movies about cowboys and ranch romances, the agriculture and food industries are a cornerstone of the American economy, currently supporting over 34 million diverse jobs and accounting for 5.6 percent of the country’s total GDP in 2023.

Tokio Marine HCC has played a pivotal role in enabling the growth of this sector for the last 50 years. Our goal has always been to deliver exceptional customer service, which exceeds the expectations of insureds. While much has changed in that time, we have been working side by side with agents and clients to increase yields from the development of new technologies, but also weather the storm from particularly bad seasons.

Cultivating Lasting Partnerships

In comparison to other lines of insurance, agriculture is distinctly characterized by its focus on strong, lasting relationships and supporting the everyday American farmer and rancher. At TMHCC, our relationships with clients span decades, passing on from generation to generation.

Through Producers Agriculture Insurance Company (“ProAg”), an agriculture-only carrier and approved provider of Federal Crop Insurance and Federal Livestock insurance, we provide three specialist products. Crop Hail policies, which are provided to agriculture producers by ProAg’s independent agent force, can be bought during the growing season as hail has the unfortunate ability to completely destroy crops. Multiple Peril Crop Insurance (MPCI) covers farmers for a loss of crop yields and/or revenue from all types of natural causes including drought, excessive moisture, freeze and disease. MPCI crop insurance covers 136 crops with 36 different plans of insurance with more than 170,000 different county/crop programs. Crop insurance protects more than $200 billion worth of crops and livestock, with more than $22 billion worth of specialty crops and farmers who buy crop insurance on more than 70 different organic crops. (Source: https://cropinsuranceinamerica.org/facts-figures/) Thirdly, to help fill the protection gap in MPCI coverage, ProAg also has a specialist portfolio of private products and named peril coverage to help farmers enhance or provide specific, diverse protection for the risks they are most exposed to.

With almost a 100-year heritage, it is safe to say, protecting farmers’ livelihoods is just as much ProAg’s bread and butter as it is their insureds.

Disaster Resilience and the Future of Agriculture

While the US agriculture industry not only fuels urban economies through a complex web of supply chains and business activities it also sustains rural communities throughout the country. However, the worsening impact of climate change and the rising frequency of stronger weather incidents have resulted in low yields.

The lack of or excess precipitation is among the most destructive perils farmers can face, and just earlier this year we witnessed just how catastrophic these conditions can be to livelihoods when farmers in Nebraska were forced to abandon their harvest from wildfires fueled by drought conditions. According to the US Drought Monitor, currently 24 US states, including Kansas, are experiencing severe to exceptional droughts. This poses a problem, as does heavy rainfall which can waterlog the soil and extreme heat.

One area in which farmers and scientists are exploring is the utilization of artificial intelligence to support yields and protect against the impact of climate change. While the great American Midwest may not always be immediately associated with cutting-edge technology, it is in fact at the fore of the development of sophisticated new robotics to boost agricultural production. In the last few years alone, AI adoption in agriculture has been swift, with approximately 87 percent of businesses using the technology to evaluate risks better and develop more sustainable practices that are resilient to climate change.

Although climate pressures present many uncertainties for farmers, one thing they can be sure of is our support. At TMHCC we understand how important it is to create a lasting legacy, and this only amplified in the agricultural industry.