Wednesday 13 November 2024

- Thought Leadership

Trade Credit UK Energy Sector Report 2024

Summary

- Global hydrocarbon prices have come down in year on year terms, despite geopolitical risk in the Middle East being elevated (Yemen/Israel/Iran).

- While OPEC+ has reduced supply, rising output in the Americas, coupled with lower demand from China is putting additional downward pressure on the oil price in 2025.

- As oil and gas fields in the North Sea mature, the UK is becoming increasingly reliant on hydrocarbon imports: the country’s energy dependency ratio increased to 41% in 2023.

- The UK’s efforts to decarbonise its economy by 2050 is making progress; coal has virtually been phased out of the energy mix and the share of renewables is growing steadily.

- Problematically, electricity demand is forecasted to rise by 40%-60% until 2035 and capacity increases in the renewables sector is behind schedule (and also require Chinese involvement).

- Simultaneously, the construction of new nuclear reactors in costing more time and (taxpayers’) money than initially expected; a much-needed power grid update is stalling too.

- Insolvency risk is the sector is small and likely to drop in 2025 while for the UK economy as a whole, the picture is less rosy.

- Energy prices have fallen against 2022-23 levels but domestic companies are still paying around 70% more for electricity than before the cost of living crisis, households are facing a 50% increase against 2021-23.

To view a pdf version, click here.

Fossil Fuels

The UK’s energy sector is in the middle of a seismic change as the country has pledged to become a net-zero economy by 2050. The transition is already well under way and carbon emissions have dropped by around 50% since 1990. While the UK’s energy mix has changed significantly over the past decades and coal plays no role any longer, the oil and gas extraction in the North Sea continues to play a sizable role in the British energy sector

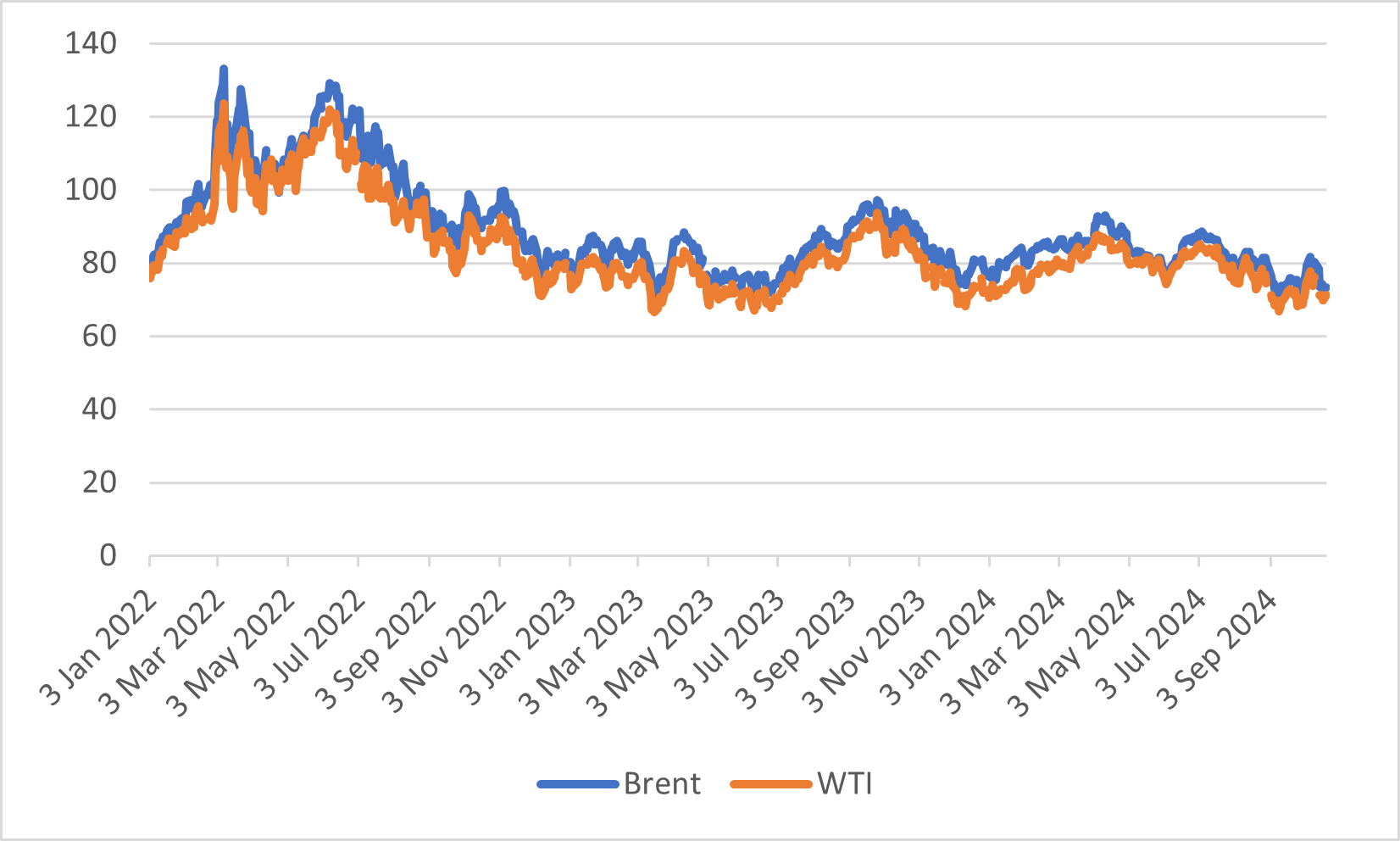

Oil Prices

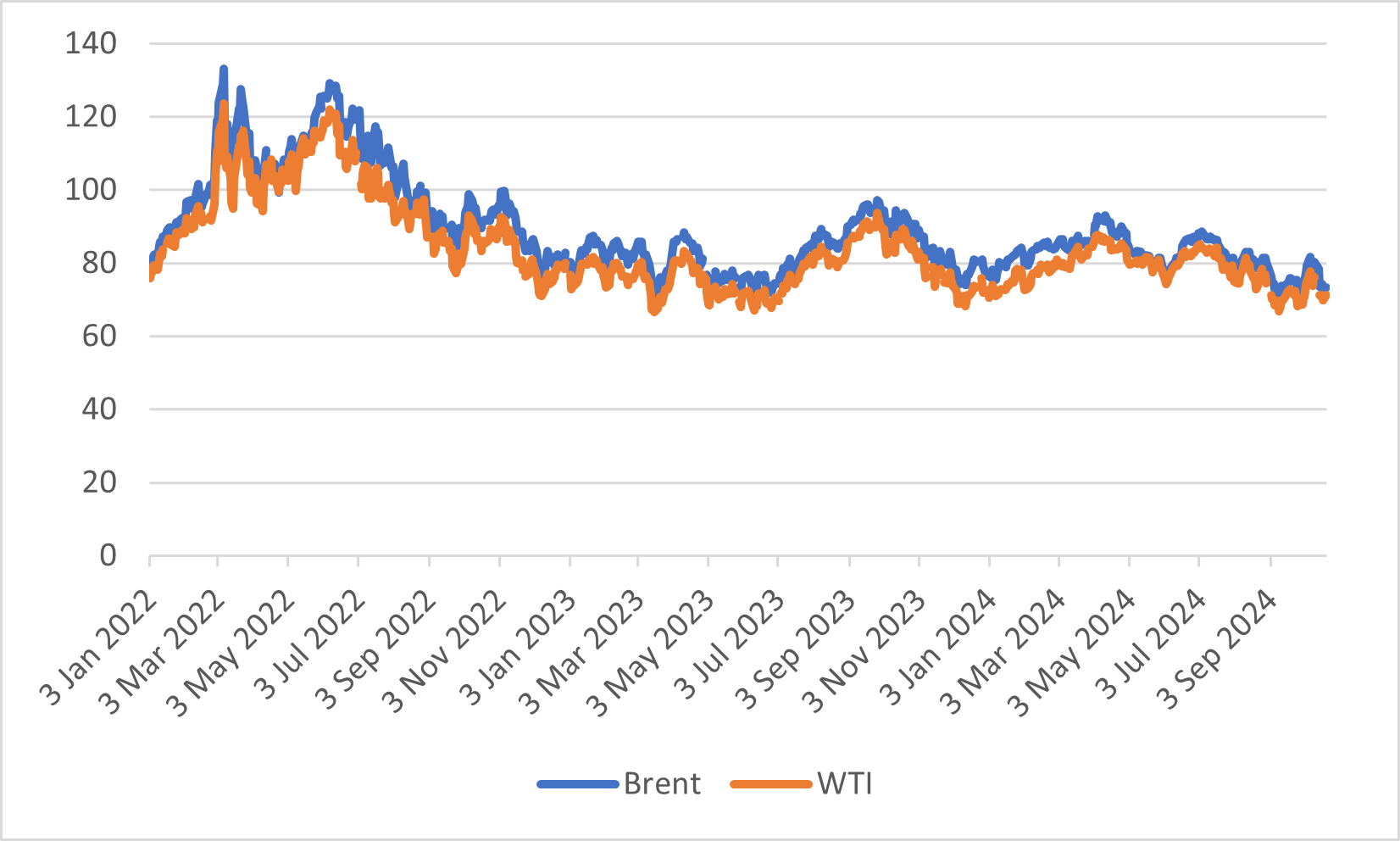

Energy prices have remained on a generally downward trend in 2024 to date. The price for a barrel of Brent crude oil has fallen by around 20% year on year (y/y) to around USD72 in late October. West Texas Intermediate (WTI) prices were down by 17.5% (to USD68) in a y/y comparison as markets have normalised.

Chart: Crude Oil Prices (in USD per barrel)

Source: US Federal Reserve Bank St. Louis

According to the latest Commodity Markets Outlook from the World Bank, global oil prices are likely to remain under pressure in 2025-26 as oversupply meets reduced demand. As countries are moving away from oil towards cleaner energy sources and China is seeing a macroeconomic slowdown, global oil demand is forecasted to expand by 900,000 barrel per day (b/d) in 2024 and by 1m b/d in 2025, according to the International Energy Agency. This is significantly below the 2m b/d increase recorded in the post-Covid recovery phase in 2022-23. According to the International Energy Agency’s Oil 2024 report, “peak oil” will occur in 2029 with China and India being the main driver of increased demand. From the end of this decade onwards, global oil demand is projected to fall although other forecasters expect a much later peak oil date: OPEC forecasts it to occur in 2045, the US Energy Information Administration in 2050.

On the supply side, political turmoil in Libya and field maintenance in Kazakhstan and Norway have curtailed output in 2024 and OPEC+ (which includes Russia) has continued with its production cuts in order to move global oil prices higher. That said, non-OPEC+ production is forecasted to rise by 1.5m b/d in 2024-25 (the Americas account for 80% of these gains) which will at least partially offset the reduced OPEC+ reduction and provide downward price pressures. As a result, OPEC+ might postpone its previously announced December 2024 output increases.

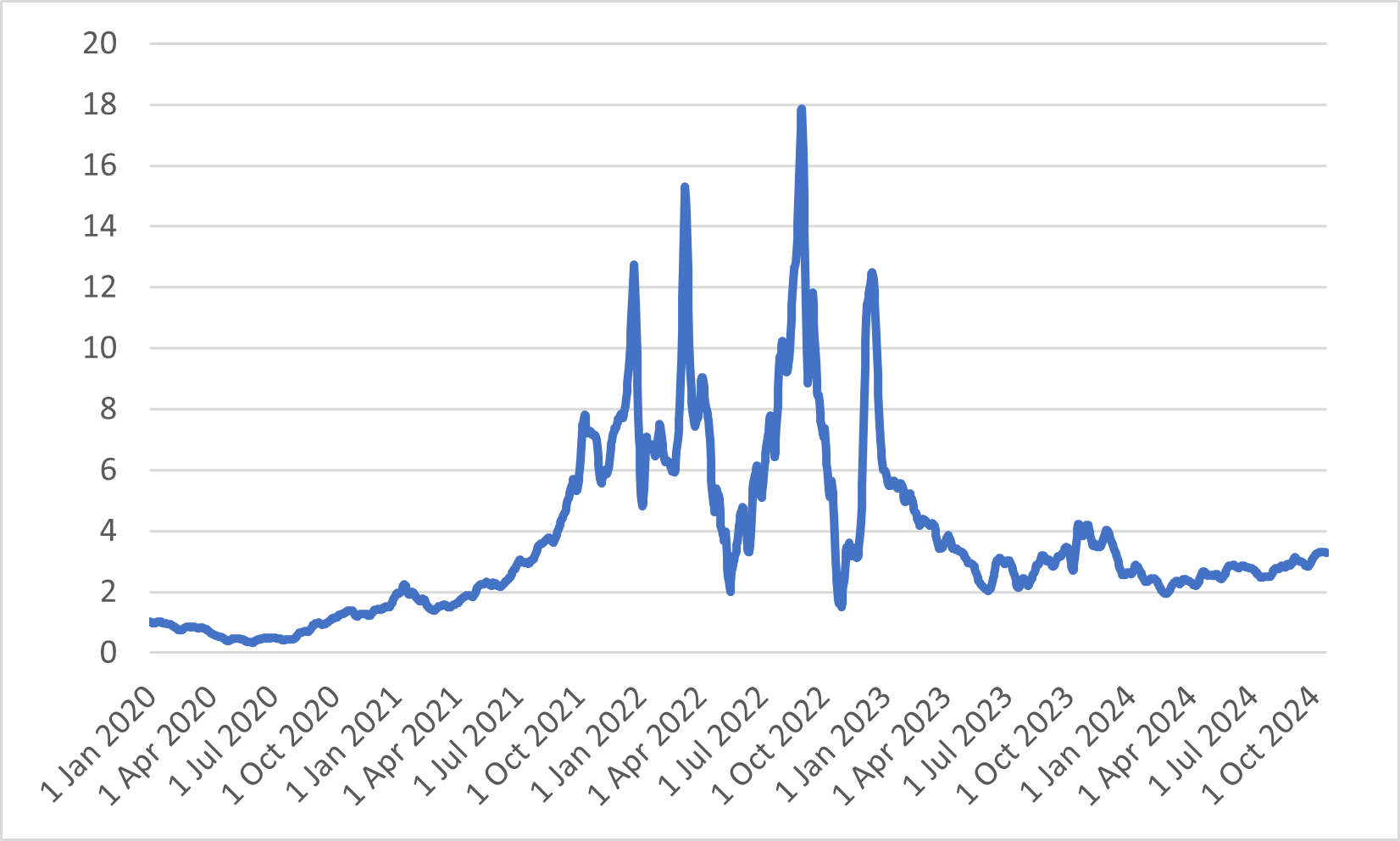

Natural Gas Prices

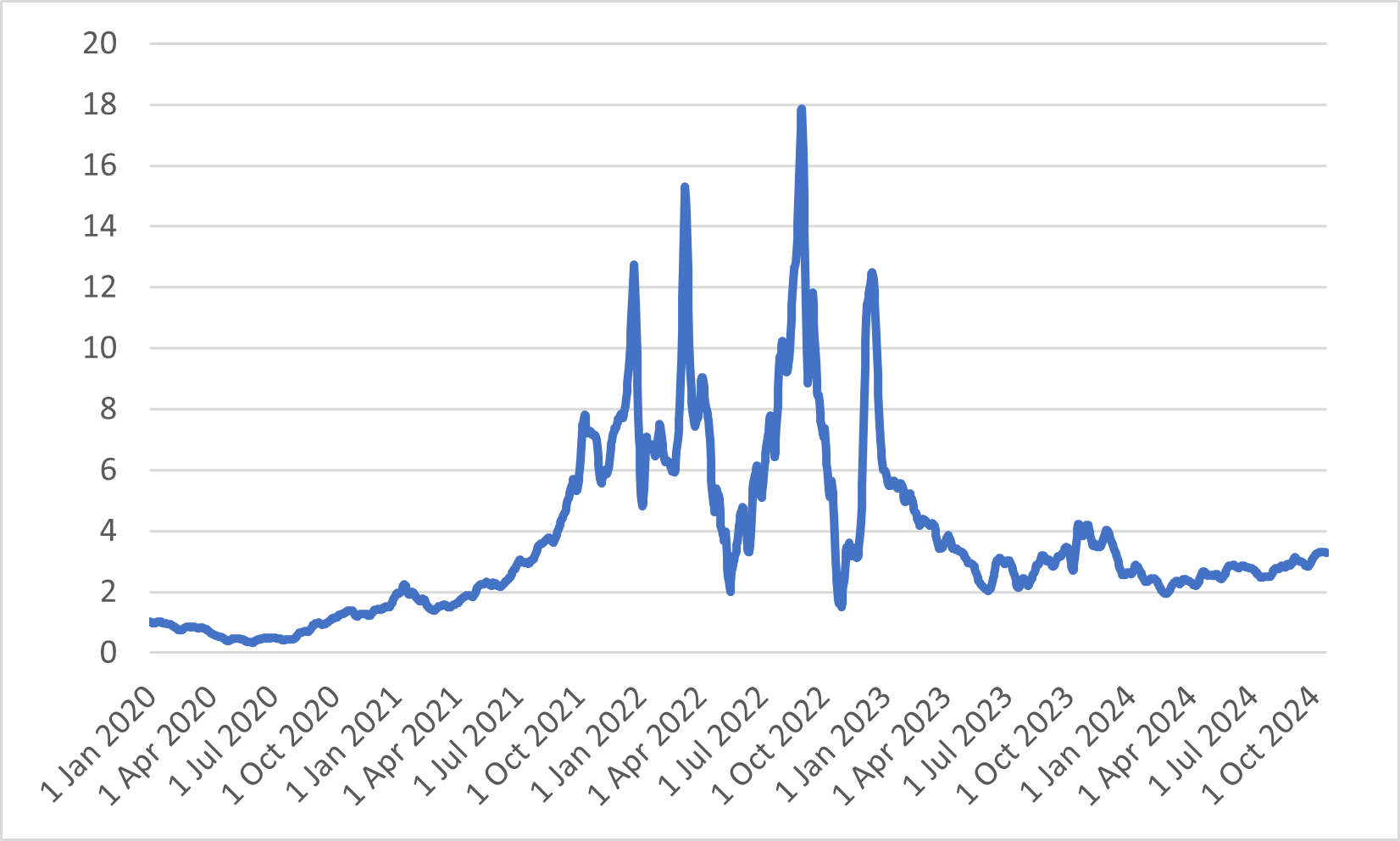

Following sizable turmoil during the early phases of the Russia-Ukraine war, natural gas prices in the UK have moved lower again. The system average price (seven days average) peaked at close to 18 pence per kWh in August 2022 but has since moderated: in the twelve months to October 2024, the price averaged 2.8 pence, according to data from the Office for National Statistics (ONS).

Chart: System Average Price of Gas (seven days rolling average, in pence per kWh)

![]()

Source: ONS

Despite the recent price decreases, natural gas prices in the UK are still far above pre-pandemic readings. Compared with the 2019-average, prices are still twice as high. Worryingly, the World Bank forecasts a modest increase in European natural gas prices in 2025 (compared against 2024-levels), thereby curtailing households’ disposable income and increasing companies’ cost base.

UK Oil and Gas Production

Problematically for the country’s energy security, the UK is no longer self-sufficient as energy imports have been outstripping energy exports for quite some time. Following the discovery of oil and gas fields in the North Sea in the 1970s, the UK became a net exporter of energy in 1981. North Sea production peaked in 1999 and since 2004, the UK has been an importer of energy again.

Table: UK Energy Dependency over Time by Energy Source

|

2000

|

2010

|

2020

|

2023

|

|

Coal

|

39%

|

52%

|

47%

|

63%

|

|

Gas

|

-11%

|

7%

|

46%

|

46%

|

|

Oil

|

-55%

|

-3%

|

12%

|

47%

|

|

Total

|

-17%

|

13%

|

30%

|

41%

|

Source: UK Department for Energy Security and Net Zero

Following the closure of the Coryton refinery in 2013, the UK has also become a net importer of fuels. The announced shutting down of the Grangemouth refinery in 2025 will exacerbate this trend. When all sources are combined, 41% of the country’s energy consumed was imported in 2023, up by 4 percentage points on the previous year.

Looking ahead, UK oil and gas production is forecasted to fall further, making the country even more reliant on (hydrocarbon) energy imports. According to the UK government’s North Sea Transition Authority (NSTA), crude oil production is set to fall by 6.4% in 2024 as fields continue to mature. This is on top of a 10.7% drop in 2023; further reductions in output are pencilled in for the 2025-2029 period. UK gas extraction is also expected to drop: the NSTA expects an 8.2% decrease in 2024, after a 9.2% contraction in 2023. Between 2020 and 2029 (the end of the NSTA’s forecast horizon), natural gas production in the UK is forecasted to halve, oil production will follow a similar pattern.

Chart: UK Oil and Gas Production

![]()

Source: North Sea Transition Authority

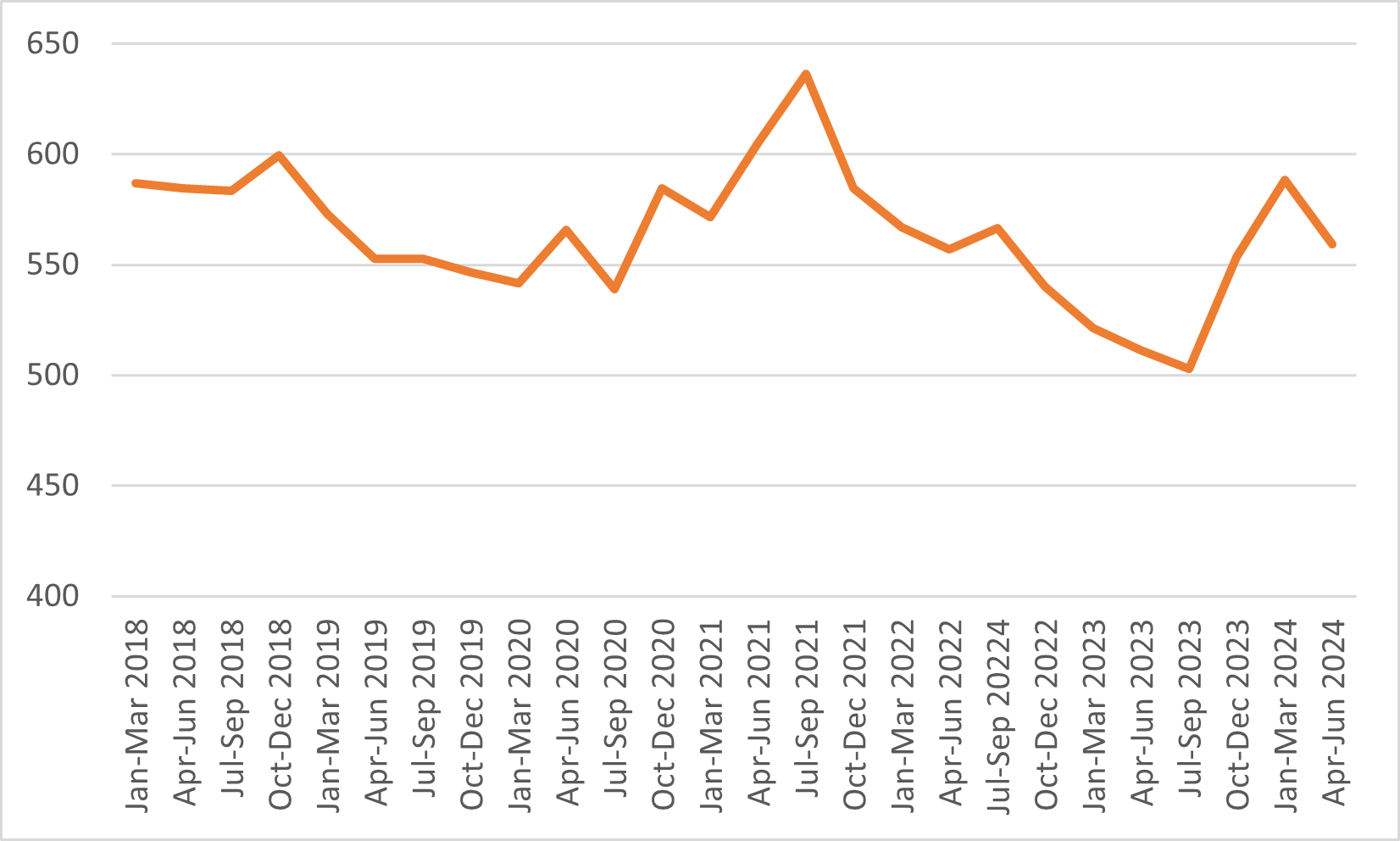

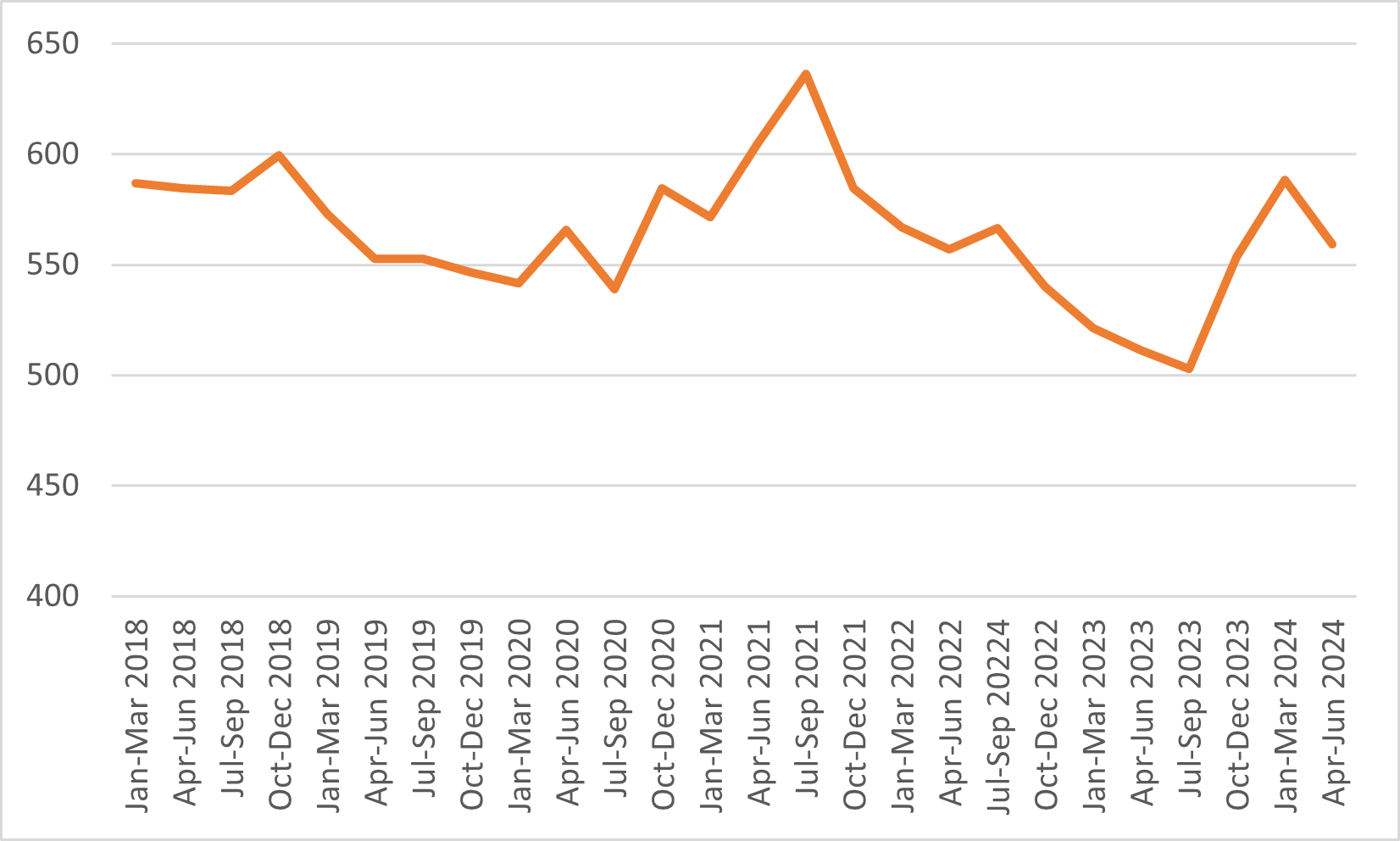

Labour Market

Meanwhile, employment in the sector has decreased over the past years. Latest data from the ONS shows that 559k people were employed in the mining, energy and water supply sector (the ONS does not break down employment further) in Q2 2024, compared with 587k workers at the beginning of 2018, equivalent to a 5% drop.

Chart: Employment in the UK Mining, Energy and Water Supply Industry (in thousands)

![]()

Source: ONS

This development is against the national trend: between Q1 2018 and Q2 2024, overall employment figures rose by 2% (to now 33.0m). However, compared with other blue-collar jobs, the decline in sectoral employment is still moderate: in the above-mentioned period, manufacturing lost 7% of its jobs, construction 12% and agriculture 20%.

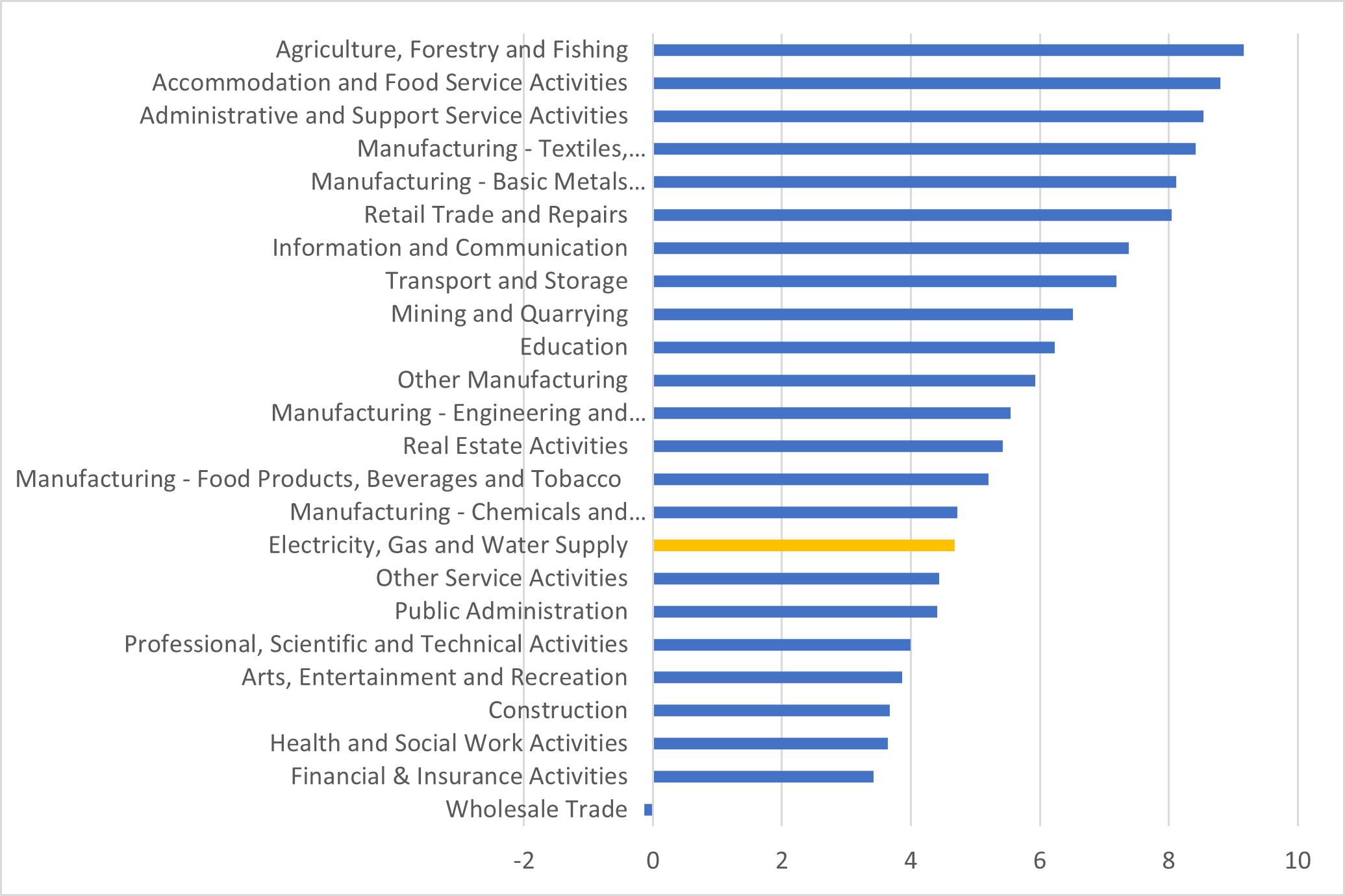

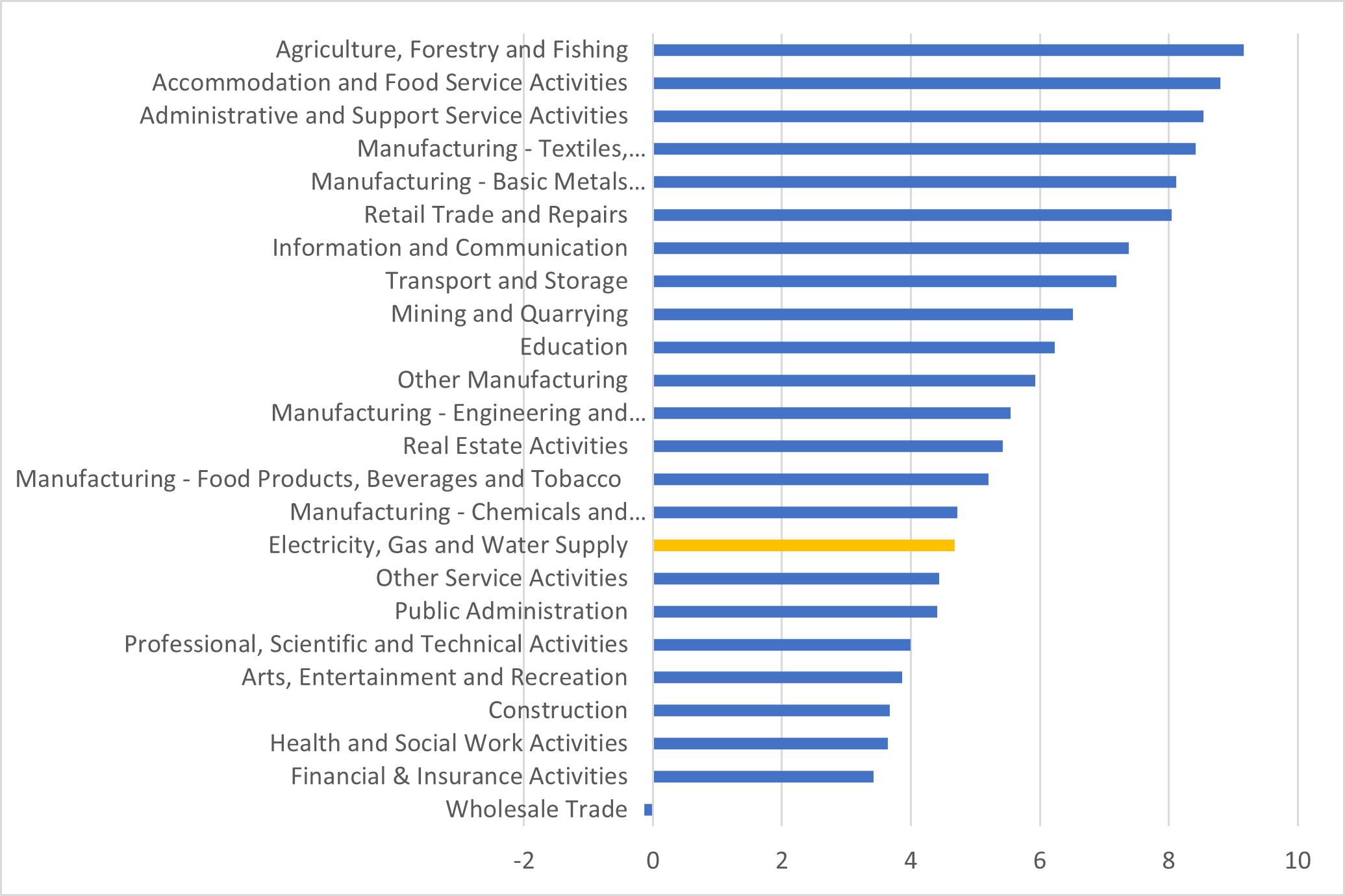

From a renumeration perspective, developments in the electricity, gas and water supply sector mirror the generally sluggish performance. At first glance, weekly earnings growth figures (including bonuses and arrears) look sound. Between September 2023 and August 2024, ONS data shows an average y/y growth figure of 4.7%. In 2019 (the last year without Covid-caused distortions), the corresponding figure stood at 2.8% only.

Chart: Average Y/Y Weekly Earnings Growth (including bonuses & arrears) Sep 2023 – Aug 2024 in %

![]()

Source: ONS

However, when compared to other sectors, the growth rate looks less stellar. Only eight sectors reported lower wage growth in September 2023 to August 2024 while 15 sectors saw salaries go up faster than in the electricity, gas and water supply industry. Also, problematically, inflation averaged 3.4% during the same period, leading to a very modest real wage growth of 1.3% only.

Power Generation

The UK’s energy mix has changed significantly over the past decades. In September 2024, Ratcliffe-on-Soar power station, the last remaining operational coal-fired power station closed, bringing an end to 142 years of coal generating electricity in the UK. Coal production in the UK has also virtually ended with the last large surface mine in Ffos-Y-Fran closing in late 2023.

At the same time, the proportion of energy produced from low-carbon sources (renewables plus nuclear) has increased sharply over the past two decades. According to the government’s UK Energy in Brief 2024 Report, the country obtained 20.7% of its primary energy from low-carbon sources in 2023, up from 9.4% in 2000. The importance of nuclear energy has actually dropped over the past years as existing reactors are ageing and more renewables capacity is installed.

Chart: Proportion of UK Energy Supplied from Low Carbon Sources (in % of Total Energy Supplied)

![]()

Source: Department for Energy Security and Net Zero

Looking solely at electricity production in the UK, Q2 2024 marked the third consecutive quarter in which more than 50% of total production came from renewables. In April to June, 51.6% of all electricity was produced from solar, wind or other renewable energy sources. Fossil fuels accounted for 37% of electricity generation in the same period, a new record low.

Chart: Electricity Generated by Fuel Type 2023

Source: Department for Energy Security and Net Zero

The Challenges Ahead

Renewables

Looking ahead, the importance of fossil fuel for the UK’s energy and electricity production is likely to fall further. The government remains committed to decarbonise the economy. Previous administrations have met the self-imposed targets and the incumbent one will have to reduce emissions by 68% until 2030 (against 1990 readings). In order to achieve that, the UK government has promised to fully decarbonise the power sector by 2035. This will require sizable investment in renewables (and, to a smaller degree, nuclear), especially as electricity consumption is also forecasted to rise by 40%-60% until 2035 (as heating and transport systems will become more electrified). Against this backdrop, previous governments have pledged to create up to 50GW of offshore wind by 2030, increase solar capacity by 70GW by 2035 and to realise up to 24GW of nuclear energy by 2050.

Positively, some progress has been made over recent years. Between Q2 2019 and Q2 2024 (latest available data), renewable electricity capacity in the UK has increased by 25% (to 57,528MW). Solar photovoltaics capacity grew by 28% (to 16,948MW), onshore wind by 13% (to 15,613MW) and offshore wind by a sizable 61% (to 14,720MW capacity in Q2 2024). Dogger Bank A, one of the world’s biggest offshore wind farms (with a capacity of 1.2GW) has become partially operational in 2024 but its completion date has been pushed back to 2025 due to supply chain constraints. Turbine failures in August 2024 also highlighted the potential problems of offshore wind power again.

Problematically, the recent growth rates are not sufficient to meet the decarbonisation targets. Offshore wind capacity would need to treble while solar and onshore wind output would need to double, all also posing a severe strain on the UK’s unprepared power grid. Positively, National Grid is currently carrying out the largest overhaul of the power network in generations, spending an additional GBP30bn in 2024-26 but fierce opposition from locals will slow down the construction of new lines. Meanwhile the newly elected government has created a new national green energy provider, GB Energy but its budget to support the net zero transition is insufficient.

Furthermore, renewable energy projects, like all investment projects have been impacted by higher interest rates and double-digit inflation rates in 2022-23. In 2023, Swedish energy giant Vattenfall cancelled plans for a 140-turbine offshore wind development in the North Sea as costs had increased by 40%. In Scotland, Community Windpower put its Sanquhar II onshore project on hold after development costs had increased from GBP300m to GBP500m. Between mid-2021 and mid-2023, costs for wind turbines grew by 38% and prices for the seven most significant minerals for the wind industry increased by 93%

Positively, interest rates are declining gradually again and commodity prices have started to moderate as well. In the solar industry, which is dominated by Chinese producers (accounting for 80% of global output and 45% of British solar panel imports in 2022), prices for panels have halved between mid-2023 and mid-2024 because of deliberate Chinese overproduction. While this is enabling cost-effective capacity increases in Europe, it is also putting domestic producers at risk of bankruptcy while simultaneously creating exposure to communist-led China. Unlike in the US, European governments have so far been reluctant to introduce tariffs on Chinese solar industry imports in order to not endanger deployment targets.

Nuclear

Problematically, four of the country’s five operational nuclear power plants (all operated by EDF) are reaching the end of their life span in this decade. Hartlepool and Heysham 1 are scheduled to go offline in 2026 with Heysham 2 and Torness following in 2028. Sizewell B (the last remaining reactor, opened in 1995) was scheduled to be decommissioned in 2035 but EDF has announced plans to extend its life by at least 20 years.

Currently, only Hinkley Point C is under construction, a nuclear power plant that will include two 1,630Mw reactors. It is privately built and operated (also by EDF) but the UK government is ensuring the owner’s returns through so called “contracts for difference” and is hence financially liable. Problematically, the project is already several years behind plan and significantly above budget. Initial estimates foresaw costs of GBP18bn and the project to be completed by 2025. However, these targets have since then slipped immensely. Currently, experts expect the power plant to go online in 2030-31 and costs to overrun by GBP28bn.

Despite the delays and cost increases at Hinkley Point C, the new Labour government seems to remain committed to investing in nuclear energy going forward. In the 2024 Autumn Budget, released on 30 October, the chancellor awarded an additional GBP2.7bn of taxpayer money to the Sizewell C project (another UK nuclear power plant project that, ten years in, is still in the planning phase though). Only in August 2024, the UK government had invested GBP5.5bn in Sizewell C, on top of the GBP2.5bn that had already been granted previously.

Insolvency Risk and Energy Price Cap

Positively, the risk of bankruptcy in the UK’s energy sector is small, according to data from the government’s Insolvency Service. In 2023, less than 100 companies that were involved in oil or gas extraction, manufacturing of energy sector related equipment and the generation or distribution of electricity and gas went under in England and Wales. At the same time, overall insolvency figures increased to a 30-year: 25,163 companies became insolvent in 2023.

Table: Company Insolvencies in England and Wales

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

Jan-Aug 2024

|

|

Extraction of crude petroleum and natural gas

|

7

|

3

|

4

|

7

|

11

|

11

|

4

|

|

Manufacture of refined petroleum products

|

1

|

1

|

2

|

2

|

0

|

1

|

2

|

|

Manufacture of electronic components and boards

|

8

|

6

|

13

|

4

|

4

|

17

|

6

|

|

Manufacture of general purpose machinery

|

13

|

3

|

7

|

6

|

10

|

8

|

4

|

|

Electric power generation, transmission and distribution

|

42

|

54

|

40

|

76

|

62

|

33

|

19

|

|

Manufacture of gas; distribution of gas through mains

|

9

|

5

|

8

|

8

|

13

|

8

|

7

|

|

Total Company Insolvencies England and Wales

|

16051

|

17171

|

12631

|

14058

|

22129

|

25163

|

16361

|

Source: Insolvency Service

This is not surprising, given the small size of sector, relative to the active business universe. But even when compared against prior year, insolvency risk in the UK energy sector is not concerning. While overall figures in England and Wales grew by almost 14% in 2023 (the third consecutive annual increase), most energy sub-sectors saw sizable drops. Only the manufacture of electronic components and boards industry (which includes solar panels) saw an immense rise: from 4 insolvencies in 2022 to 17 in 2023. Turbine production (which falls under general purpose machinery) saw a 20% drop (from ten to eight insolvencies) though.

Positively for the sector, energy regulator Ofcom has approved a 10% quarter on quarter energy price cap increase for Q4 2024, following two reductions in Q2 and Q3 2024. That said, compared with Q4 2023, the price cap is 6% lower and against the final quarter of 2022 (during the most severe period of the cost of living crisis), it has fallen by 49%.

Furthermore, slighter higher wholesale prices will likely trigger another rise of Ofgem’s energy price cap: against October-December 2024, the January-March 2025 cap is forecasted to increase by 3% (to then GBP1,762 for customers with typical consumption levels). Positively, following the ongoing normalisation of the energy market, suppliers have started to offer fixed tariffs again. However, given the recent experiences, it is likely that energy companies will remain cautious in their approach; prices are likely to be set close to the cap levels. The return of competition in the UK energy market is forecasted to be slow, according to the House of Commons Library, parliament’s in-house research service. Despite the moderation seen in 2023-24 and government efforts to support consumers, energy prices in the UK are currently still around 50% above early 2021 readings, thereby curtailing disposable income and holding back growth.

For UK businesses, Ofcom’s energy price cap does not apply though. Hence companies are much more exposed to the price increases in the energy sector, especially as the government’s Energy Bill Relief Scheme and the Energy Bills Discount Scheme have ended. As a result, an average restaurant or retailer (consuming 50Mwh a year) is paying around GBP5,000 per year more for electricity than before the crisis. Annual electricity bills are forecasted to average GDP13,264 by April 2025, down from the GBP21,000 in 2022-23 but still 70% more than in 2020-21, according to a study released by Cornwall Insight, a research firm.

Higher electricity prices (compared with pre-cost of living crisis readings), increased wage costs (the minimum wage will go up to GBP12.21 per hour in April 2025, a 6.7% rise), comparatively high interest rates and tighter bank lending conditions all have the potential to keep insolvency risk in the British economy high as companies’ profit margins are undermined. On the upside, economic growth is switching into a slightly higher gear in 2025 and interest rates are forecasted to drop somewhat. However, it is unlikely that UK insolvency figures will respond immediately, 2025 will be another year with elevated credit risk levels in the UK.

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.

Related links