Wednesday 11 December 2024

- Thought Leadership

UK Construction Sector Report

Summary

- Operating conditions in the sector are still challenging and mixed.

- Most building materials have become cheaper over the past year, thereby ending a period of record high inflation (which severely undermined profits).

- Construction sector output was still falling in mid-2024 but the repair and maintenance subsector performed well and business optimism is rising.

- Sectoral output is forecasted to increase by 2.5% in 2025 and 3.8% in 2026.

- Problematically, wages are rising quickly and labour shortages remain an issue, thereby holding back growth.

- The new government has implemented some changes since coming into office (such as re-implementing mandatory housing targets); UK construction will face a higher tax bill but can also benefit from increased public investment and the net zero transition.

- UK Credit risk will moderate in 2025 as the economy will grow faster and interest rates will come down gradually (without reaching the 2009-2022 levels though).

- That said, insolvency risk in construction will remain much higher than the national average as the sector continues to operate on slim profit margins (around 2%) and fixed price contracts.

To view a pdf version, click here.

Key Trends in 2024

Inflation

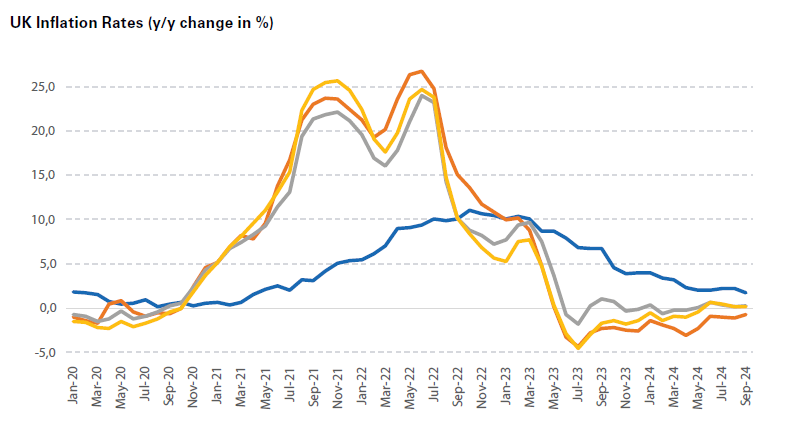

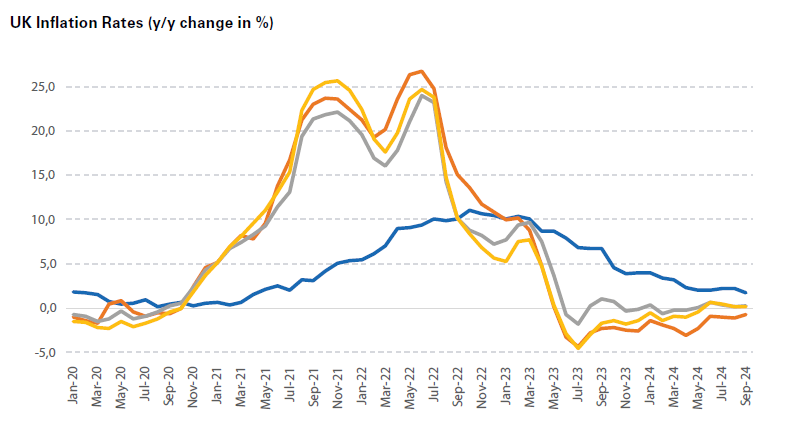

Positively, inflationary pressures have subsided further in 2024. After peaking at 11.1% in October 2022 (a 40-year high), consumer price inflation in the UK has moderated in 2023-24. Latest available data for September 2024 shows that the consumer price index (CPI) increased by 1.7% year on year (y/y), the lowest reading since April 2021 and below the Bank of England’s (BoE) 2%-target for the first time since July 20211.

Source: ONS

Inflation in the construction sector has generally followed the CPI pattern but peaked at much higher rates in 2022. According to data from the Office for National Statistics (ONS), the “all construction work” price index saw a record high 26.8% y/y increase in June 2022 before moderating again. Since June 2023, the index has been in deflation territory but certain product groups are still recording sizable price increases. In the twelve months to September 2024, costs for pipes and fittings rose by 17.6%, followed by precast (+6.3%) and ready-mixed concrete (+5.0%). The three construction materials with the biggest price decreases in October 2023 to September 2024 were electric water heaters (-3.4%), imported plywood (down by 3.5%) and fabricated structural steel (-7.3%)2.

Problematically, despite the recent deflation pressures in the industry, price levels are still far above pre-Covid readings, highlighting the sector’s much higher cost base: between

September 2024 and January 2020, the construction material price index has increased by almost a third (31.5%), leaving companies (and customers) with much higher material costs.

Also, problematically, output price inflation in the sector lagged input price inflation in 2022-23. While costs for building materials went up by more than 20% in y/y terms in 2022, output prices only increased by around 10%, thereby eroding margins. Positively, with input price inflation in negative territory since mid-2023 and output price inflation averaging 2.7% y/y in Q3 2023 to Q2 2024, UK construction companies are now finally experiencing some much-required relief3.

Output

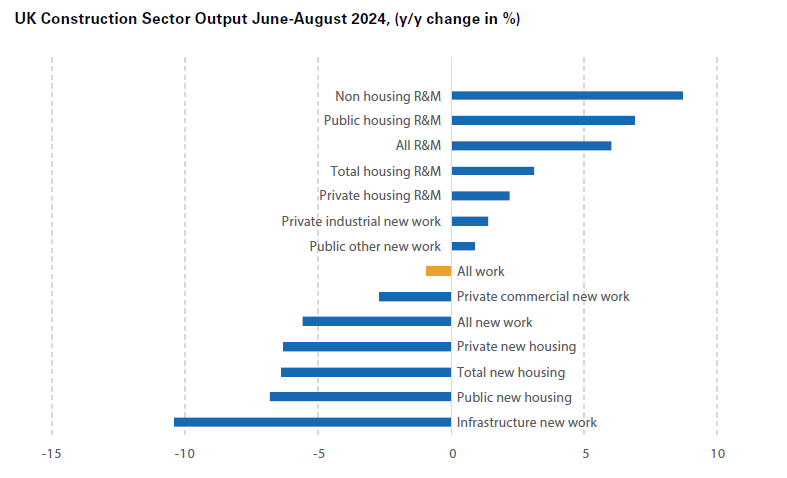

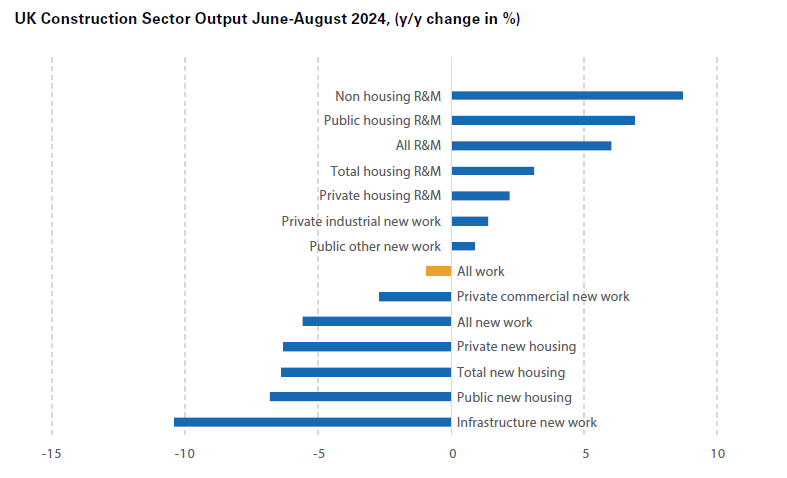

While conditions in the UK construction sector have generally brightened somewhat throughout 2024, output data still paints a mixed picture. In the three months to August 2024, total sector output was down by 0.9% against the same period one year ago. However, a closer look reveals that while new work continued to contract, the repair and maintenance (R&M) sub-sector performed much better. While the “all new work” index fell by 5.6% y/y in June to August 2024, “all R&M” increased by 6.0%.

Source: ONS

Meanwhile, other metrics also continue to show some ongoing weakness in the sector. Gravel and sand sales have been falling (in y/y terms) since Q4 2022; latest available ONS data for Q3 2024 shows another 5% contraction, on top of the double digits drops between Q1 2023 and Q2 2024. Sales of ready-mixed concrete have also been declining since mid-2022. Q2 2024 (the latest available data point) shows a hefty 23% y/y drop, the sharpest reduction since Q2 2020 (when Covid-lockdowns were in place). Furthermore, bricks production also dropped in Q3 2024 (by almost 10% y/y) and concrete blocks output is down too (-7.6% y/y).

Foreign trade data highlights the UK construction sector’s reliance on imported materials. While the UK exported construction materials worth GBP2.12bn in Q2 2024, imports stood at a much higher GBP5.48bn, leading to a trade deficit of GBP3.36bn, the highest reading in four quarters. The top five import goods in 2023 were electrical wires (GBP2.49bn), lamps and fittings (GBP1.08bn), sawn wood >6mm thick (GBP1.03bn), air conditioning equipment (GBP994m) and builders ironmongery (GBP826m)4. While the EU remains the most important trading partner in the construction industry, accounting for 60% of exports and 61% of imports in 2023, exposure to the US (which took around GBP1bn worth of UK construction material exports in 2023) could become an issue following the re-election of Donald Trump as this has increased the risk of higher tariffs.

Labour Market

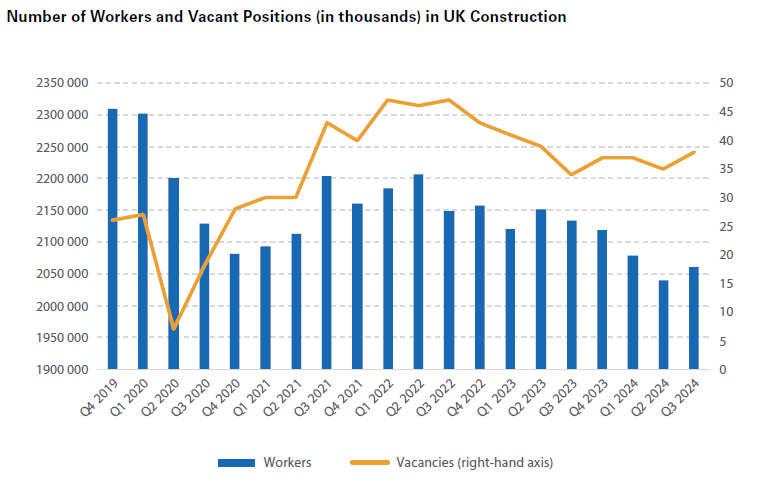

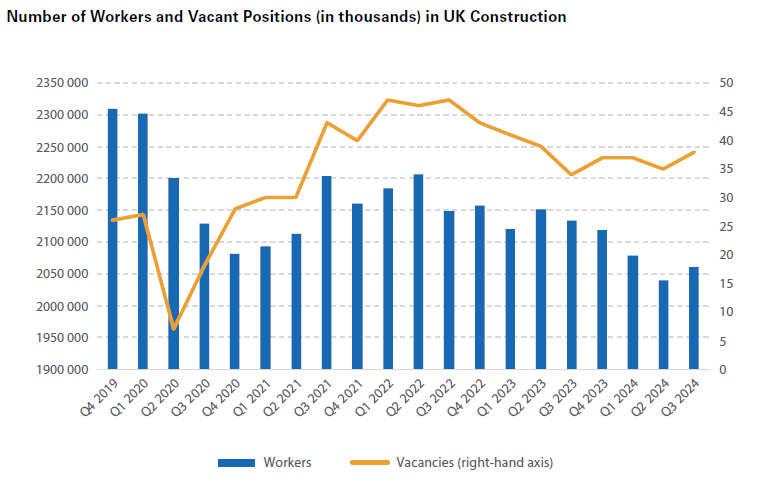

The construction industry remains an important sector of the UK economy. In 2023, it generated 6.3% of total gross value added in the country5. In terms of jobs, the sector employed 2.06m workers in Q3 2024, more than the finance and insurance sector (1.40m), information and communication (1.64m) or accommodation and food services (1.76m).

As a share of total, construction employs 6.1% of the UK workforce. However, while overall employment in the UK has risen slightly since the start of the pandemic (from 33.0m to now 33.4m), the construction sector has seen a 11% drop since Q4 20196.

Source: ONS

That said, the number of job vacancies in the sector remains stubbornly high, indicating ongoing labour market tightness as construction companies are unable to fill open positions. While the number of vacancies in the UK has dropped from its 1.3m peak in mid-2022 to 831k in Q3 2024, the situation in the construction sector has changed by a much slower pace: in July-September 2024, the industry recorded 38k open positions, compared with 50k vacancies in mid-2022.

Furthermore, while the overall level of vacancies has almost moderated to pre-Covid readings again (in late 2019, there were 810k open positions in the UK), the trend in the construction sector looks very different: compared with Q4 2019, the number of vacancies in UK construction is up by 10k (from 28k to now 38k)7. As a consequence, the vacancy ratio (the ratio of open positions per 100 employee jobs) in the sector has also increased: from 1.7 in Q4 2019 to 2.4 in Q3 2024.

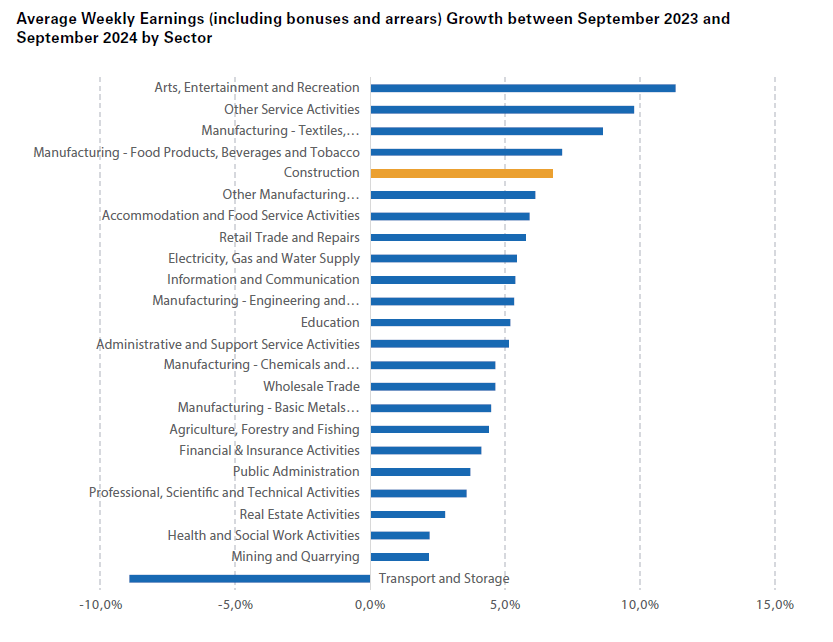

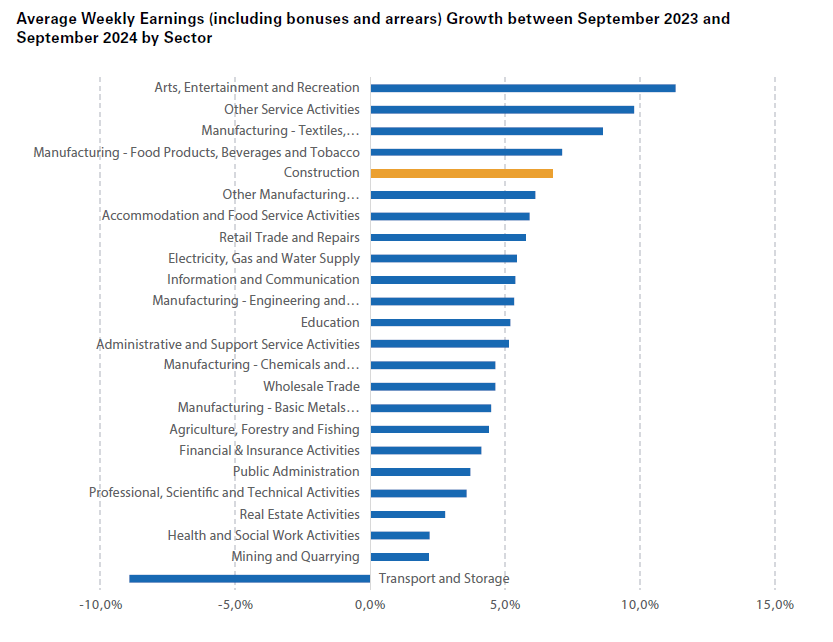

Sectoral wage developments re-iterate the scarcity of labour in UK construction and also add to the higher cost base. Data from the ONS shows that in y/y terms average weekly earnings (including bonuses and arrears) increased by an above-average inflation reading of 6.7% in the twelve months to September 2024. Only four out of the 24 sectors surveyed reported higher growth rates in the above-mentioned period8.

Source: ONS

2025 Outlook

Positively, UK construction is likely to benefit from a generally improving macroeconomic backdrop in 2025 with real GDP growth forecasted to switch into a slightly higher gear and interest rates likely to fall further. At the same time, sectoral confidence indicators are in growth territory as well and the new Labour government’s first budget contains

announcements that will be beneficial for the construction sector (such as additional funding for home insulations and social housing)9. That said, several downside risks still

persist, ranging from high levels of credit risk, strict planning regulation and new ESG targets to persistently lower demand for office and retail spaces.

Macroeconomics

Encouragingly, the British economy is forecasted to switch into a (slightly) higher gear in 2025. According to the International Monetary Fund’s (IMF) World Economic Outlook, last updated in October 2024, real GDP growth in the UK will accelerate to 1.5% in 2025, up from an estimated 1.1% in 2024. Inflation will come in at 2.0% for 2025 as a whole, thereby meeting the BoE inflation target10.

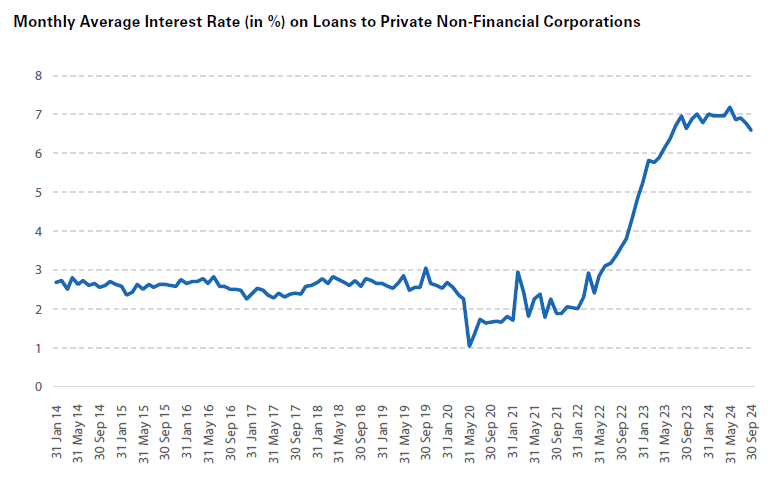

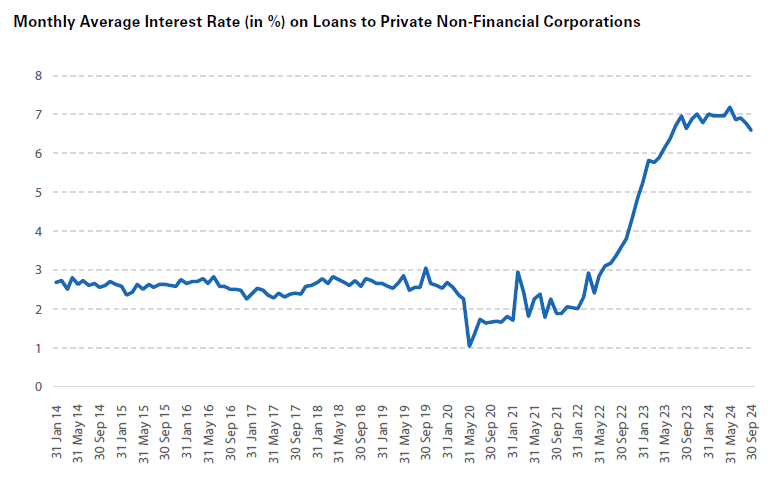

As inflation will be under control, additional interest rate cuts are likely, on top of the two 25 basis points reductions seen in 2024. Problematically, lending terms have tightened over the past years and despite the recent cuts, interest rates are still far above the readings seen between 2008-2022. This is complicating companies’ and households’ access to credit and is still undermining demand in the construction sector.

Source: Bank of England

Confidence Indicators

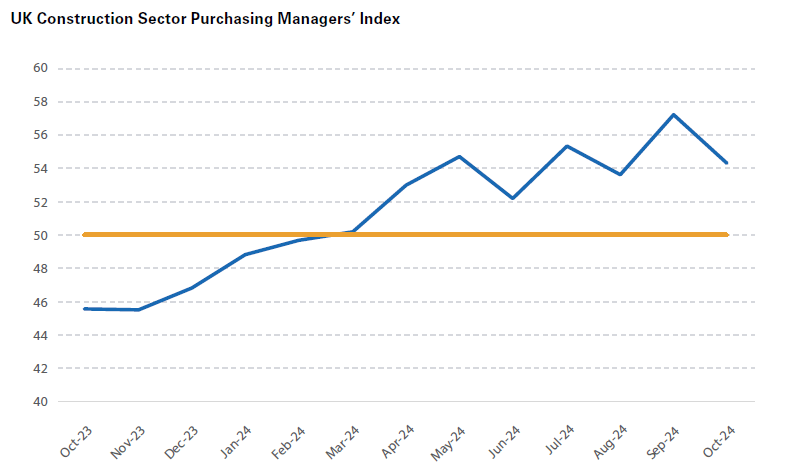

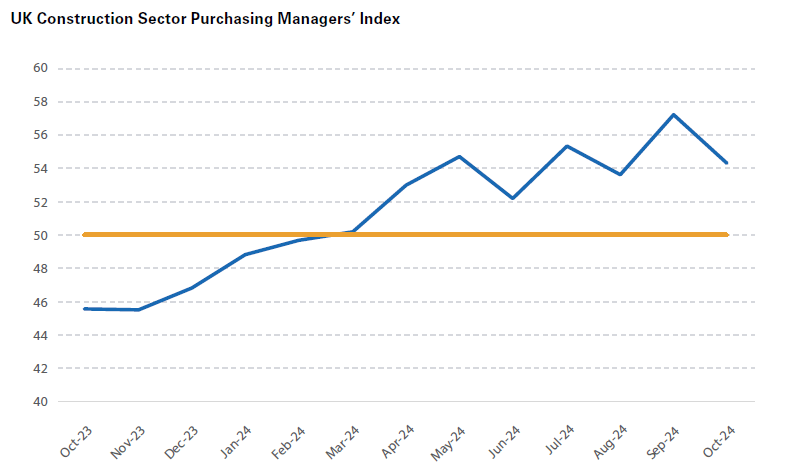

Meanwhile, S&P Global’s UK Construction Sector Purchasing Managers’ Index for October 2024 shows that survey respondents are predominantly optimistic about the year ahead, although to a smaller degree than in the previous month11. With a reading of 54.3 points, the PMI is down from September’s 29-month high of 57.2 points. That said, it remains comfortably above the 50-points line which divides optimism from pessimism and it also compares very favourably against the corresponding eurozone reading of 43.0 points.

Source: S&P Global (neutral line: 50 points)

Civil engineering (56.2 points) was the best performing subindex, followed by commercial work (52.8). Meanwhile, house building (49.4) fell below the neutral 50-points line for the first time since June but the rate of contraction was marginal. Survey respondents mentioned elevated refinancing costs and the uncertainty ahead of the Autumn Budget as main constraints.

New order inflow moderated somewhat from September’s twoand- a-half year high but many construction companies mentioned sound sales pipelines and tender opportunities, linked to the gradually improving macroeconomic conditions in the UK. While the current robust new order inflow will not provide any imminent support for the sector (given the long lead times of construction projects), it points towards a better medium-term future.

The 2025-26 forecasts of the Construction Products Association (CPA), published in October 2024 also show growing optimism. While the CPA expects UK construction output to shrink by 2.9% this year, it expects a 2.5% expansion in 2025, followed by 3.8% growth in 202612. Falling interest rates and cheaper mortgages will stimulate demand in residential building (the biggest subsector), the CPA forecasts 8.0% growth in 2025 (and 7.0% in 2026), after a hefty 9.0% drop in 2024. As consumer confidence and real wages have also risen in 2024, repair and maintenance (the second biggest sub-sector) is also projected to grow (by 3.0% in 2025 and 4.0% in 2026). Infrastructure, the third largest sub-sector will also return to growth: following a small, 0.4% drop in 2024, the CPA is pencilling in 1.8% and 3.6% growth for 2025 and 2026, respectively.

Politics and Regulatory Environment

Snap elections in July brought an end to 14 years of Conservativeled governments in the UK. The centre-left Labour Party returned to power with a clear majority (402 out of 650 seats) and announced major changes in its first Autumn Budget in October 2024. From a cost perspective, companies will have to brace for a higher minimum wage (which will generally push wages upwards) and increased national insurance contributions (plus lower allowances)13. At the same time, the government announced investment in railway infrastructure (a Trans-Pennine upgrade and limited work on High Speed 2 in London), earmarked GBP5bn for affordable housing projects (with a focus on Liverpool and Cambridge14) and GBP3.4bn for the warm homes plan (which will fund insulations) as well as increasing spending on school refurbishments (budget: GBP2.1bn for maintenance andGBP1.4bn for rebuilding schools)15. Increased spending on the NHS will also partially support UK construction as GBP1bn has been earmarked for repairs and upgrades. Furthermore, GBP1bn was set aside for removing hazardous fire cladding, a result from the Grenfell Tower Fire inquiry.

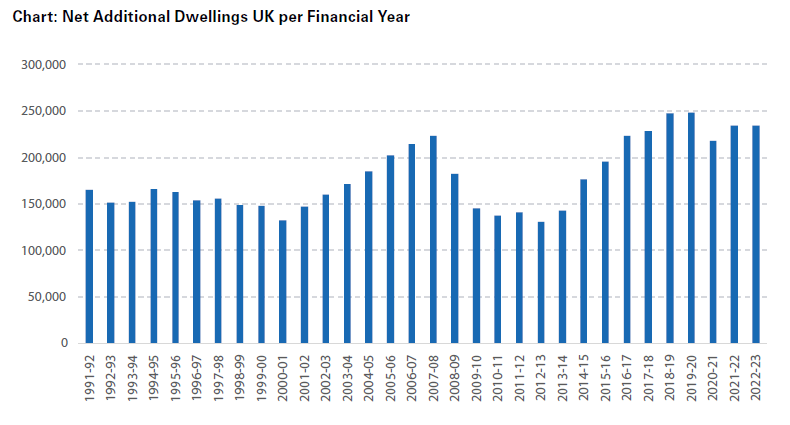

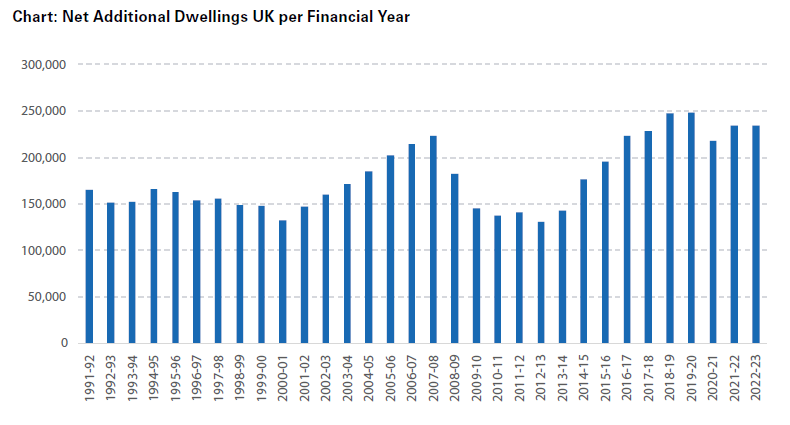

On the planning side, the government has reintroduced mandatory housing targets for local governments (which were abolished by the Sunak government) and has pledged to build 1.5m houses during this 5-year parliamentary term. In addition, a promised overhaul of planning laws and hiring an additional 300 planning officers are also measures that will help to “get Britain building again”16.

Source: Department for Levelling Up, Housing and Communities

However, the government’s plan to increase construction sector output to 300k new homes per year is based on overly optimistic assumptions. Never before has the UK been able to complete so many new homes per year. The latest figure for the 2022-23 financial year stood at 234k only, unchanged from 2021-2217. Planning reforms (such as enabling more building work in the so-called grey belt or low-quality green belt) have featured highly on Conservative government’s agendas as well but progress has

been slow. Although this might be related to the high churn in the Department for Housing (16 ministers during the 14 years of Conservative governments in 2010-24), it is more likely that other, more persistent factors such as labour shortages, high costs and public opposition to new housing developments are holding back construction sector output.

In terms of ESG regulations and de-carbonisation, the Labour government has committed to ambitious targets that are directly or indirectly impacting on UK construction. For example, banks and other financial institutions will be forced to implement and publish credible transition plans that align with climate goals. As a result, credit to the construction industry might be more limited as the sector’s carbon emissions are comparatively high. Especially SMEs are facing additional red tape to comply with banks’ and the governments’ incoming ESG rules. The introduction of a carbon border adjustment mechanism and an update of the emission trading scheme could also increase operating costs in the sector. However, at the same time, British construction companies are likely to benefit from higher demand for house insulations as subsidies have already been increased in the Autumn Budget18. The sector will also see higher demand for infrastructure upgrades as well as carbon-free energy production.

Credit Risk

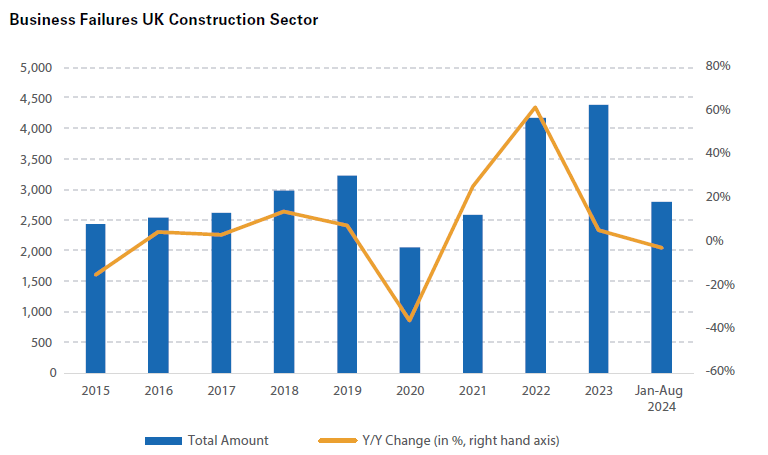

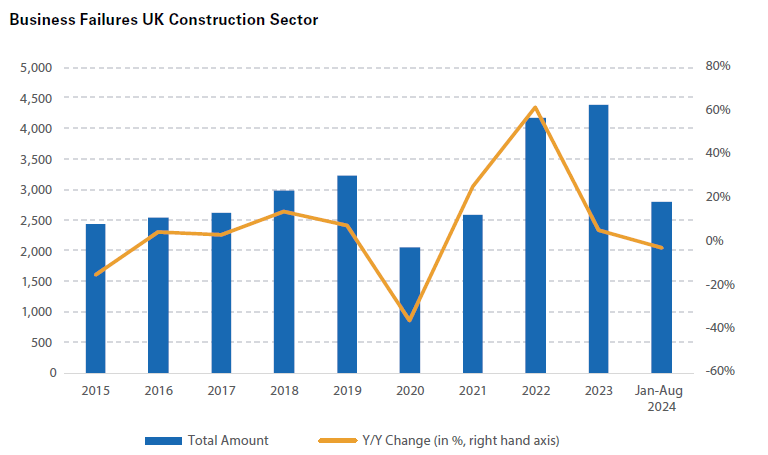

The collapse of ISG, the UK’s sixth-largest construction company by turnover in September 2024 highlighted the elevated levels of credit risk in the sector again. With 2,200 workers being made redundant and GBP180m of debt being owed to trade suppliers, this is the biggest insolvency since the failure of Carillion in 201819. Once again, slim margins (plus unexpected cost increases) were to blame for the bankruptcy of a UK construction company: in 2022, ISG made had a turnover of GBP2.18bn but its pre-tax profit stood at GBP11.2m only20.

Problematically, the full effects of the ISG collapse are yet to be felt in the sector as several sub-contractors will certainly default now too. This comes at a time when insolvency risk in the sector is elevated already. The industry has seen 4,387 company insolvencies in England and Wales in 2023, more than any other sector and the worst reading since the global financial crisis. Last year saw the third consecutive annual increase and although figures were down by a modest 2.7% y/y in January to August 2024, they still remain far above pre-Covid readings21. The rising number of employee ownership trusts in the sector is also a source of concern, given the high amount of EOT failures in recent quarters (often caused by too-high committed contributions to previous owners)

Source: Insolvency Service

Positively, all three sub-sectors for which the government’s Insolvency Service provides data show y/y improvements in January to August 2024. Construction of buildings accounted for 1,041 out of the construction sectors 2,804 insolvency registrations, down by 3.2% against January-August 2023. Meanwhile, civil engineering saw 138 failures, down by 6.1% y/y. Specialised construction activities (accounting for 58% of all construction sector bankruptcies in the first eight months of 2024) reported a 2.0% y/y improvement.

While insolvency risk has likely peaked already, it will remain above pre-Covid levels for the foreseeable future. Higher macroeconomic growth, slightly lower interest rates and better business and consumer confidence readings will all help to stimulate construction sector output in 2025-26. While fixed price contracts will remain the norm (as they provide stability for investors), construction companies will no longer be exposed to double digit inflation rates. This reduces vulnerability in the sector.

Lastly, poorer payments performance in the sector is also causing problems again. According to a 2023-study, large construction companies in the UK pay around 20% of their invoices late22. This is especially worrisome for smaller companies towards the bottom of the supply chain as they tend to have smaller capital buffers and rely on prompt payments. Although the recent deterioration in B2B payments performance is only a normalisation towards pre-Covid levels (the sector always had a poor payments performance, compared with most other parts of the British economy), working capital cycles often have not adapted to the changing pattern yet. This is adding to the elevated credit risk levels for the foreseeable future.

Related links:

[1] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/september2024

[2] https://www.gov.uk/government/statistics/building-materials-and-components-statistics-october-2024/construction-building-materials-commentary-october-2024

[3] https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/datasets/interimconstructionoutputpriceindices

[4] https://www.gov.uk/government/statistics/building-materials-and-components-statistics-october-2024/construction-building-materials-commentary-october-2024

[5] https://commonslibrary.parliament.uk/research-briefings/cbp-8353/

[6] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/employmentbyindustryemp13

[7] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyindustryvacs02

[8] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/datasets/averageweeklyearningsbyindustryearn03

[9] https://www.pbctoday.co.uk/news/planning-construction-news/labour-delivers-their-first-autumn-budget-but-is-construction-being-left-behind/145195/

[10] https://www.imf.org/en/Countries/GBR

[11] https://www.pmi.spglobal.com/Public/Home/PressRelease/bac3785941674c38a68c1d6113d62ef9

[12] https://www.constructionproducts.org.uk/news-media-events/news/2024/october/press-release-cpa-releases-autumn-forecasts/

[13] https://www.ciob.org/blog/uk-autumn-budget-2024-key-announcements-for-the-built-environment

[14] https://www.financial-news.co.uk/uk-budget-2024-opportunities-for-construction-sector/?utm_source=email&utm_medium=sfmc&utm_campaign=UK-FUTBU-LON_Newsletter_EM_Subscriber_Prom_08_Nov_379

[15] https://www.pbctoday.co.uk/news/planning-construction-news/labour-delivers-their-first-autumn-budget-but-is-construction-being-left-behind/145195/

[16] https://www.cityam.com/chancellor-rachel-reeves-unveils-planning-reforms-to-get-britain-building-again/

[17] https://www.gov.uk/government/statistics/housing-supply-net-additional-dwellings-england-2022-to-2023

[18] https://commonslibrary.parliament.uk/research-briefings/cbp-8353/

[19] https://www.companyrescue.co.uk/guides-knowledge/news/the-collapse-of-isg-is-the-biggest-in-the-sector-since-carillion-in-2018/

[20] https://www.wfw.com/articles/collapse-of-isg-and-contractor-insolvency-another-stark-warning-to-the-construction-industry/

[21] https://www.gov.uk/government/statistics/company-insolvency-statistics-september-2024

[22] https://www.constructionnews.co.uk/financial/major-contractors-admit-they-pay-20-of-invoices-late-15-08-2023/