Tuesday 19 November 2024

- Thought Leadership

UK Retail Sector Report

Summary

- After a very challenging 2022-23, high-frequency data shows the worst for the sector seems to be over as sales have hit a two year high in August 2024.

- Lower inflation, interest cuts, real wage growth, stronger real GDP growth and improved consumer confidence are all providing (modest) tailwinds for UK retailers.

- Problematically, transportations costs have risen substantially in mid-2024 and despite some improvements in Q3 2024, freight rates are still far above their long-term averages.

- Positively, after three annual increases in a row, the number of business failures in the sector is now finally falling: in January to August 2024, it decreased by 5.7% year on year.

- That said, there were 20,000 UK retailers in financial distress in Q3 2024, highlighting the still above long-term average credit risk levels.

- Political stability has increased following the general election in mid-2024 but with government debt being on record high levels, noteworthy fiscal support (via tax cuts) for the sector is unlikely.

To view a pdf version, click here.

Key Trends in 2024

Positively, most recent data indicates that the worst for the UK retail sector seems to be over as the cost of living crisis has come to an end. Lower inflation, rising real wages and increasing consumer confidence have all led to a small uptick in retail sales figures.

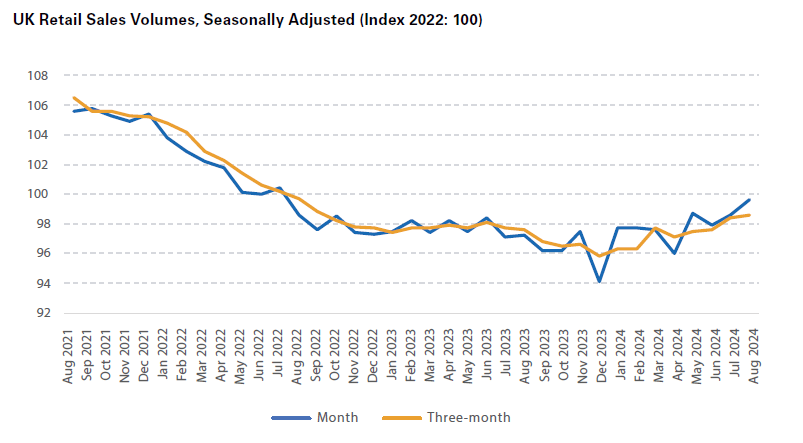

Retail Sales Figures

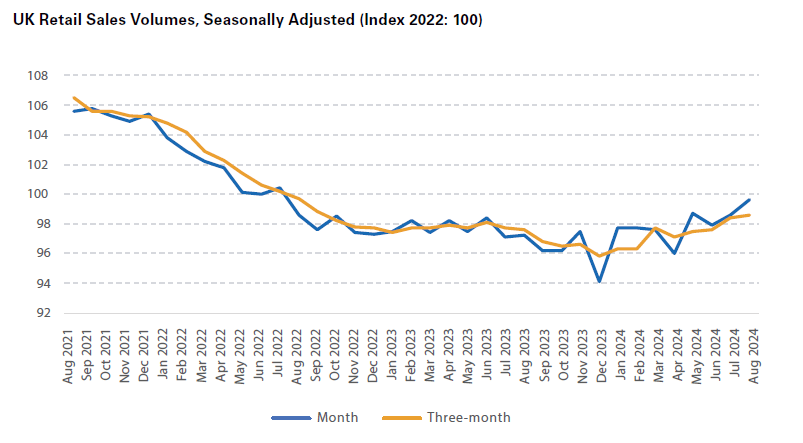

According to figures from the Office for National Statistics (ONS), UK retail sales volumes have increased by 1.2% in the three months to August 2024. In August, sales (in volume terms) were on the highest reading in 25 months and the 2.5% year on year (y/y) increase wasthe largest annual rise since February 20221.

Source: ONS

Positively, ONS data shows that the uptick in August was spread evenly across most sub-sectors. Increases ranged from a 0.2% month-on-month (m/m) rise in department store sales to an unseasonably robust 2.9% expansion in textiles and clothing. The only outlier in August were other non-food stores which recorded a 1.0% m/m drop in sales.

That said, compared over a longer time horizon, retail sales performance is still disappointing: against the pre-Covid reading from February 2020, figures are still down by 0.4%. While non-essential spending initially did well during the subsequent lockdowns (as holiday and dining-out budgets were rerouted), the cost of living crisis in 2022-23 has led to a drop in furniture, home electronics and other big ticket item spend.

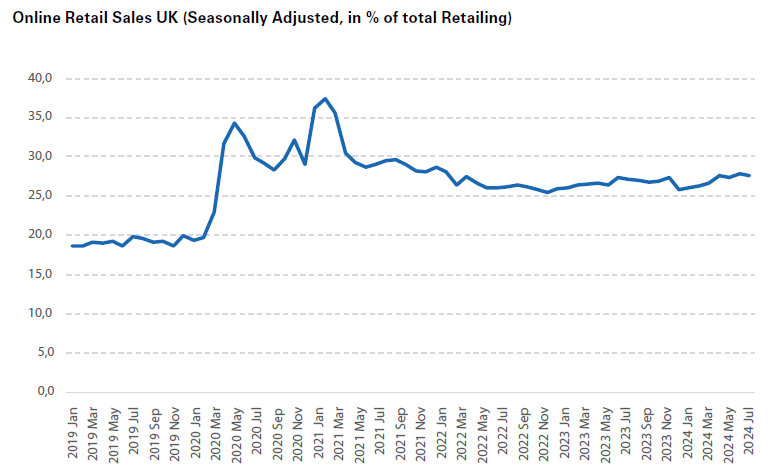

Online Sales

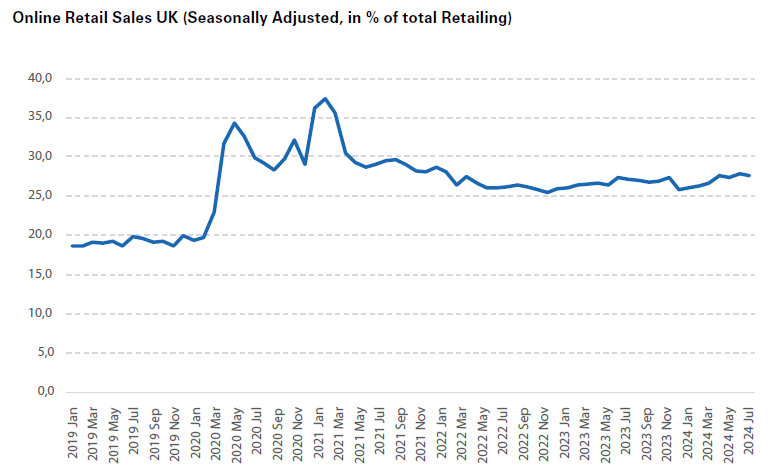

Although all Covid restrictions have been lifted a long time ago, retail shopping patterns have changed for good in 2020-22 and the share of internet sales (as percentage of total UK retail sales) has remained largely static over the past two years.

Source: ONS

Before the first lockdown in spring 2020, the share of online retail sales stood at 19.7% in February. Following the governmentmandated closure of non-essential retailing, the share increased to 34.4% in May 2020 and an all-time high of 37.4% in February 2021. Since then, figures have dropped somewhat as shoppers have returned to bricks-and-mortar shops but they remain significantly above pre-Covid levels. In August 2024, 27.6% of all UK retail spend was carried out online.

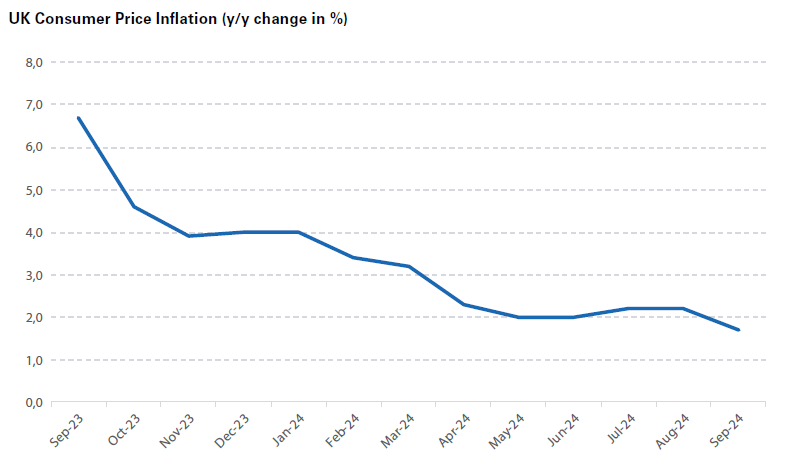

Inflation

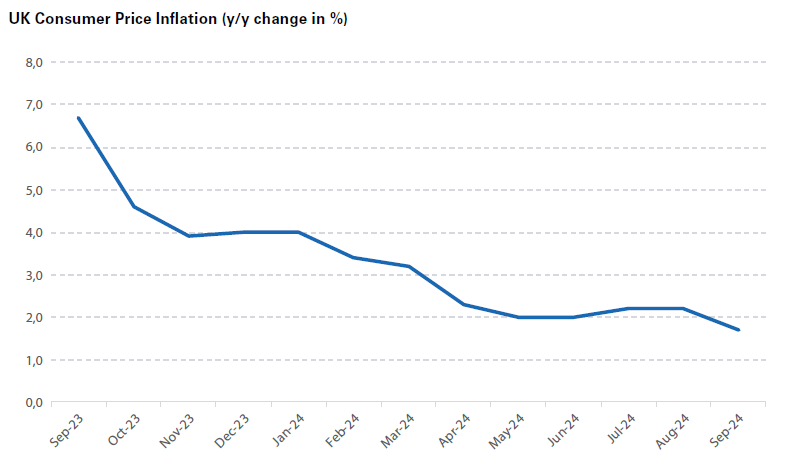

Positively, consumers price inflation continued to ease throughout 2024 to date. After having peaked on a 41-year high of 11.1% in October 2022, inflation has fallen to 1.7% in September. This is the first time in three years that inflation has fallen below the Bank of England’s 2.0% target2. Other metrics such as core inflation (which ignores prices movements for energy and unprocessed food) and CPIH (which includes owner occupiers’ housing costs) are somewhat higher (at 3.2% and 2.6%, respectively) but are also on a

downward trend.

Source: ONS

A closer look reveals that inflation in the service sector exceeds goods inflation by a sizable margin. While consumer prices for services have increased by a still elevated 4.9% y/y in September, goods have become cheaper (down by 1.4% y/y) for the sixth consecutive month.

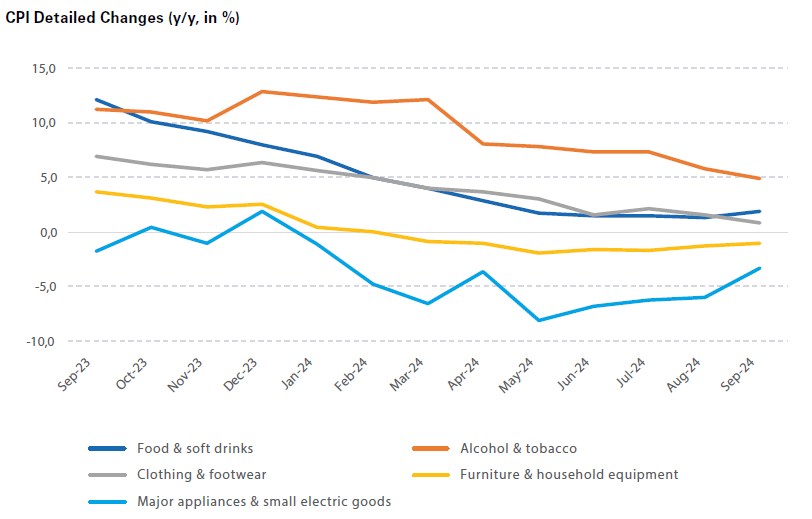

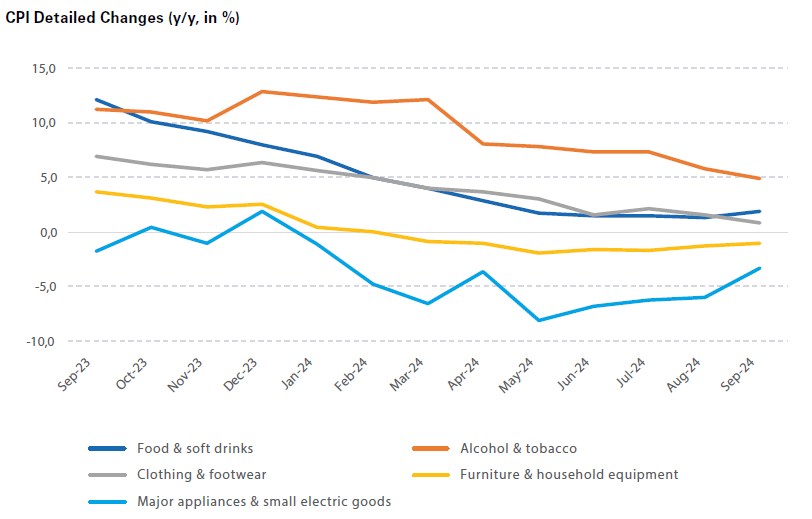

Within the goods category, most sub-indices have improved. Major appliances and small electric good have been becoming cheaper (in y/y terms) since the start of 2024 while furniture prices have also been in deflation territory since March.

Source: ONS

Prices for food and clothing are still increasing (by 1.9% y/y and 0.8% y/y, respectively) but September readings were below the Bank of England’s 2% inflation target. Alcohol and tobacco remain an outlier though: despite having been on a persistent downward trend as well, corresponding CPI readings are still at around 5%. That said, as it only accounts for around 4% of the total CPI reading, its overall importance is rather small. Looking ahead, CPI is forecasted to remain around the BoE’s 2% target.

Labour Market

According to the House of Commons Library, the UK retail sector employed around 2.7m people in 2022, down by 5% against prior year.3 At the same time, UK employment has risen by 2%. Data from the ONS bundles retail and wholesale companies together (and also includes the much smaller repair of motor vehicles industry) and is hence not fully comparable to the House of Commons publication. That said, ONS data also shows a decline in sectoral employment over the past years.

While overall employment levels have remained virtually unchanged between Q4 2019 (the last pre-pandemic reading) and Q2 2024 (the latest available data point), the wholesale and retail sector has seen a 15.5% drop in employment as shopping patterns have changed for good4. In absolute terms, the sector now only employs 3.45m people (total UK workforce in Q2 2024: 33.0m), compared with 4.1m in late 2019.

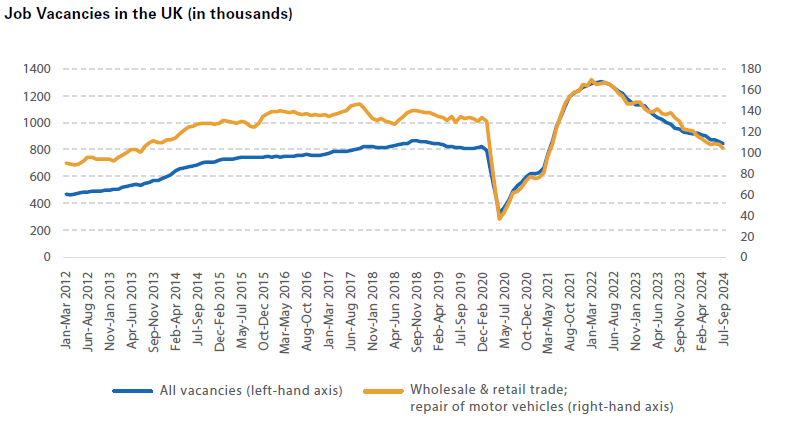

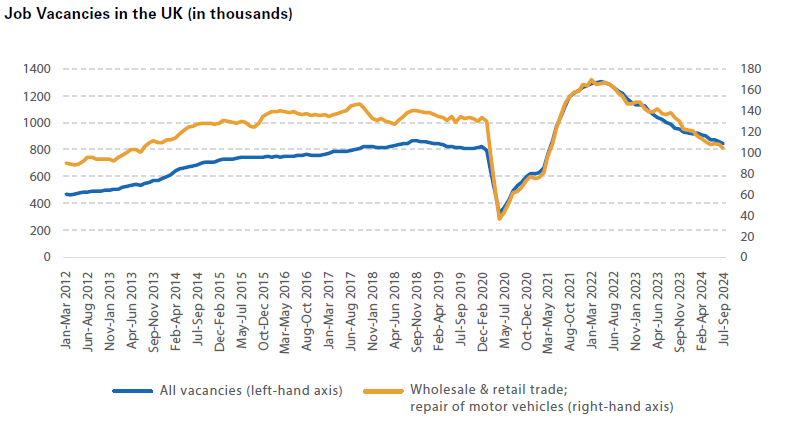

Worryingly, the number of vacant positions in the sector has also decreased in recent quarters, mirroring the problems UK retail is facing5. Although the overall number of job vacancies in the UK has been falling for more than two years in a row now, retail and wholesale are seeing an above-average deterioration. There were 104k unfilled positions in the industry in July-September 2024, the lowest reading since 2013 (when pandemic-years are ignored). Meanwhile, the overall number of job vacancies in the UK (841k) has come down from a peak of 1.3m in March-May 2022 but is still above the October-December 2019 reading of 810k.

Source: ONS

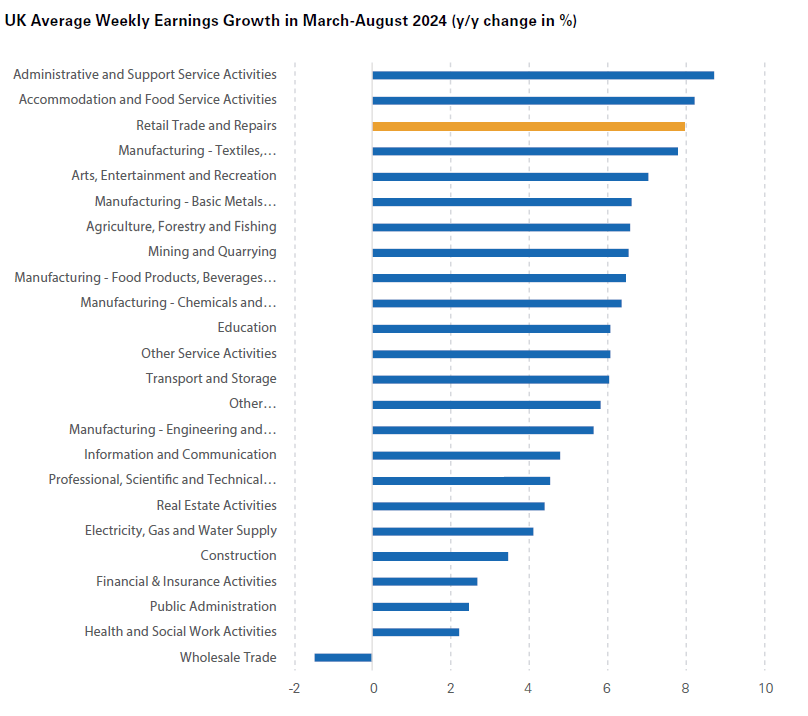

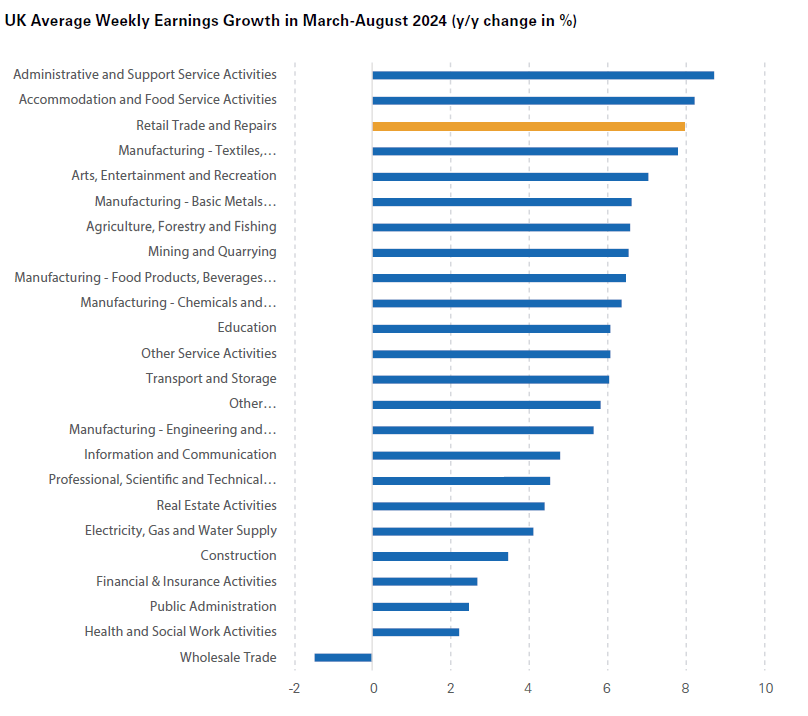

Meanwhile, the generally sluggish sectoral labour market performance has not translated into wage moderation though. According to the ONS, average weekly earnings growth (including bonuses and arrears) in the sixth month to August 2024 stood at almost 8% y/y in UK retail trade. This was far above the national average with only accommodation and food services as well as administrative and support service activities reporting higher wage growth in the same period6.

Source: ONS

With inflation having come down substantially over the past quarters, the high nominal wage growth translates into a significant increase in retail companies’ cost base, thereby

undermining profitability. Although some wage moderation has become visible across the British economy over the past months, real wage growth (nominal wages growth minus inflation) is likely to remain positive for the next quarters, thereby likely leading to a further aggravation of the sector’s cost base problem (but also to higher household budgets).

2025 Outlook

Positively, the outlook for 2025 has improved in recent months as macroeconomic growth is switching into a slightly higher gear, inflation is forecasted to remain moderate and

political stability has returned following the 2024 general election. At the same time, lower interest rates will help to reduce insolvency risk next year. That said, topics like ESG and AI will require significant investment from UK retail companies, thereby undermining profits.

Macroeconomics

Encouragingly, the IMF is forecasting UK real GDP growth to accelerate in 2024 and 2025. According to the latest set of forecasts from April 2024, the British economy will grow by 1.1% this year and by 1.5% in 2025. This is up from the 0.3% recorded in 2023 and also significantly better than the last IMF projections from October 20237. GfK’s consumer confidence indicator has taken an unexpected hit in September (when it fell from -13 points to -20) but it is expected to recover somewhat following the Autumn Budget (providing clarity for households’ finances)8. This will support domestic consumption and have a positive impact on UK retail spend.

As inflation is has come down and is forecasted to hover around the BoE’s 2% target in 2025, additional interest rate cuts are on the cards which will also provide a monetary stimulus for the economy. According to the IMF’s recommendation, rates should be cut to 3.5% by the end of 2025 (they stood at 5.0% in late October 2024), highlighting the sizable room to manoeuvre for monetary policy makers. That said, households with sizable mortgages will still feel the pain from higher interest rate costs as even with further rate reductions, mortgages will be costlier than during the 2009-2022 period (when central banks had basically cut key policy rates to zero).

Politics and Supply Chain Risk

Following the general election in July 2024, the Conservative Party was ousted after 14 years in power. Especially the final years of the Conservative administration were sometimes marked by erratic policy making and the landslide victory of the Labour Party should bring a higher degree of political stability which should help businesses to plan long-term.

That said, the new government will be forced to make several painful spending cuts in order to bring the sizable fiscal deficit under control. Although the British Retail Consortium continues to lobby for a 20% cut to business rates (a current relief scheme will expire in April 2025), it remains to be seen whether the Labour government will be in position to make noteworthy changes during the current parliamentary term as other measures might take priority9.

Problematically, supply chain disruption as well as higher shipping costs continue to weigh on the sectoral outlook, a trend likely to continue in 2025. Freight rates have soared between May and July 2024 and although some normalisation has taken place since then, they are still above 2023-readings. The Drewry WCI composite index of USD3,216 per 40ft container is 69% below the pandemic peak in September 2021 but it is still 126% more than the 2019-average of USD1,42010. The average composite index for 2024 to date (1 January -17 October) was also USD1,225 higher than the 10-year average (USD4,058 per 40ft container versus USD2,834).

Sizable security risks in the Red Sea and the Eastern Mediterranean as well as droughts impacting on the Panama Canal locks are all creating downside risks to transportation costs in 2025. At the same time, they are also endangering just-in-time supply chains as delays might become more common.

Credit Risk

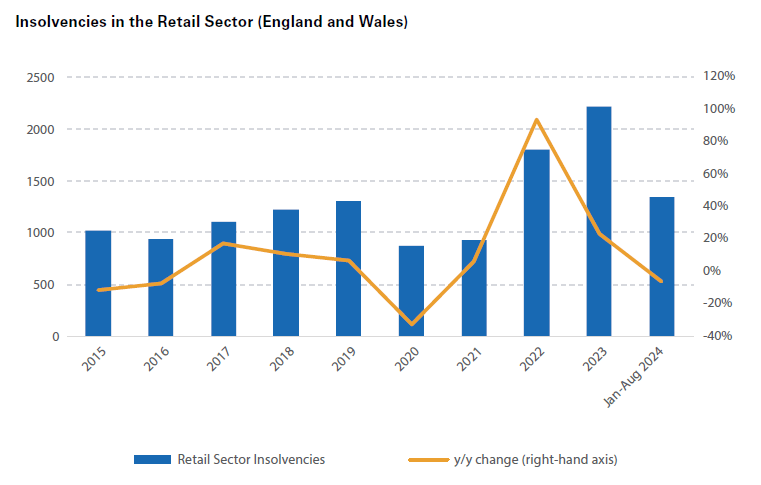

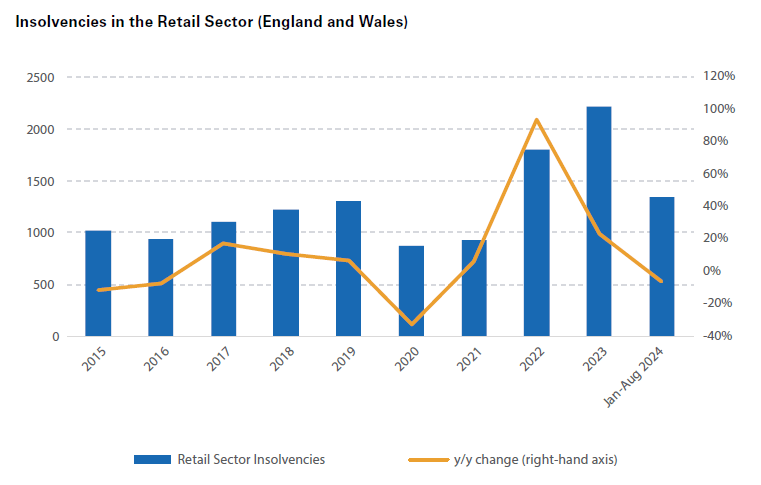

The cost of living crisis, higher interest rates and elevated inflation have pushed insolvency figures to a 30-year high in 2023. In England and Wales, around 25,000 companies became in insolvent last year, the third consecutive annual increase and up by 13.7% against 202211. The retail sector was not immune to this worrying trend: it recorded 2,219 bankruptcies in 2023, a sizeable 23.1% y/y rise.

In January to August 2024 (the latest available data point from the government’s Insolvency Service), the UK retail sector has seen some tentative improvements though. Overall, 1,344 UK retailers filed for insolvency in the above-mentioned period, down by 5.7% y/y. This compares favourable with the national development as well: the overall figure for England and Wales remained virtually unchanged (down by 0.2% y/y) in January-August 2024. Positively, the improvement was broad-based: food, ICT and household equipment retailers all saw y/y drops in the number of business failures in the first eight months of 2024.

Source: Insolvency Service

That said, despite the generally encouraging trend, the sector has continued to see some high-profile failures in 2024 to date; Ted Baker, Carpetright, MatchesFashion, Wilko and Body Shop all went under. With around 20,000 food and drug retailers reporting financial distress in Q3 2024 according to restructuring specialist Begbies Treynor12 (a 10.9% increase against Q2 2024), it is evident that credit risk remains an important topic going into 2025. Encouragingly, with the economy expected to switch into a slightly higher gear, interest rates forecasted to come down and inflation to remain muted, the insolvency outlook for next year is still somewhat brighter, compared with 2023-24.

Long-term Trends

Looking ahead, the sector will continue to see pressure on its operating models. Bricks and mortar stores have become more popular again since Covid lockdowns have ended but are unlikely to see footfall return to pre-pandemic readings as shoppers continue to make purchases online. Furthermore, with hybrid working arrangements likely to stay for good in most professions as well, inner-city shops will have to cope with a smaller customer base.

Many in the sector feel that the recently announced budget will hit retailers hard, adversely impacting growth and investment in the short term. There is also the risk that additional costs by retailers will be passed onto already stretched consumers who may not have the bandwidth to absorb the price increases. The 1.2% increase in Employers National Insurance Rates and increases in the National Living Wage (with both rates for those under 21 (up 16.28% to £10 per hour) and over (up 6.7% to £12.21 per hour) both in excess of the Low Pay Commission’s recommended increase of 5.8%), will be a substantial burden for the sector. There was also a missed opportunity for the Government to address and reform the in-balance in the business rates relief by implementing a modest tax here to mitigate a shallower decrease in relief, rather than the significant reduction

from 75% to 40%.

In addition, much needed investment in artificial intelligence and online presences, including augmented reality will continue to require sizable funding. This will adversely impact on profits, at least over the short- to medium run. Improved omnichannel experiences (providing a seamless shopping experience across all channels, from store to mobile and online) will also be key to maintain current and attract new customers. While ESG topics have become less important for customers during the cost of living crisis, rising real wages (which are increasing households’ budgets) might prompt shoppers to pay more attentions to sustainability and societal topics again. In that light, supply chain management (e.g. ensuring that no child labour is used at suppliers) and sustainability are likely to feature heavily in the sector’s in-tray over the next years.

From a macroeconomic angle, the reluctance of UK consumers to increase spending post-Covid also creates some concerns. While household consumption in the US has increased by 13% in real terms since early 2020, the corresponding UK figure stands at a low 1.5%13. Precautionary savings have increased with UK households saving twice as much as US households (10% of earning going into savings accounts, compared with 5% in the US), thereby leading to reduced demand in the UK retail sector. With households’ finances likely to improve over the next quarters, a gradual normalisation is probable however

Related links

[1] https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/august2024

[2] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/september2024

[3] https://researchbriefings.files.parliament.uk/documents/SN06186/SN06186.pdf

[4] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/employmentbyindustryemp13

[5] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/datasets/vacanciesbyindustryvacs02

[6] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/datasets/averageweeklyearningsbyindustryearn03

[7] https://www.imf.org/en/Countries/GBR

[8] https://www.gfk.com/press/uk-consumer-confidence-sees-big-fall-in-september-down-seven-points

[9] https://commonslibrary.parliament.uk/how-could-the-government-change-the-business-rates-system/

[10] https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry

[11] https://www.gov.uk/government/statistics/company-insolvency-statistics-september-2024

[12] https://www.theguardian.com/business/live/2024/oct/18/uk-retail-sales-technology-spending-hiring-slows-budget-uk-insolvencies-business-live-news?filterKeyEvents=false&page=with:block-67120b828f084087b63c0cb6#block-67120b828f084087b63c0cb6

[13] https://www.ft.com/content/35845d93-11e4-4387-b5e7-0ccfc9218ce6