Monday 03 March 2025

- Thought Leadership

UK Retail Sector Report : February 2025

Summary

- After having fallen for two years in a row, UK retail sales have increased again in 2024.

- That said, growth was lacklustre (+0.7%), consumer confidence has deteriorated substantially in Q3 and Q4 2024 and households’ savings rates are very high.

- Problematically, the UK’s 2025 real GDP growth forecast has been halved while inflation forecasts have been adjusted upwards, thereby causing additional headwinds for UK retail.

- Positively, the number of business failures has trended downwards in 2024 (-12% y/y in the retail sector in January - November)

- However, the credit risk outlook is less rosy as UK businesses will have to cope with increased national insurance contributions, a higher minimum wage, reduced business rate relief and a higher packaging levy in 2025.

- Generally, the outlook for the retail sector has clouded over the past month; businesses are likely to face another challenging year as economic headwinds are increasing and fiscal policy measures will start to bite.

To view a pdf version, click here.

Key Trends in 2024

Although sales increased in volume terms for the first time in three years, 2024 was another difficult year for the UK retail sector as consumer confidence dipped in Q3 and revenue disappointed in the important final quarter of the year and revenue disappointed in the important final quarter of the year.

Retail Sales Figures

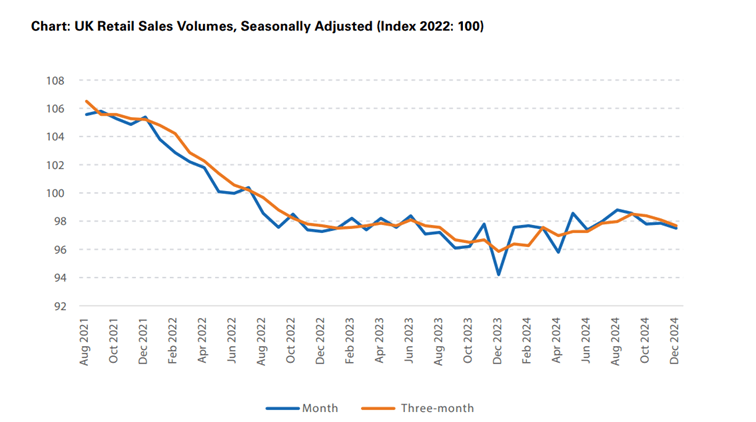

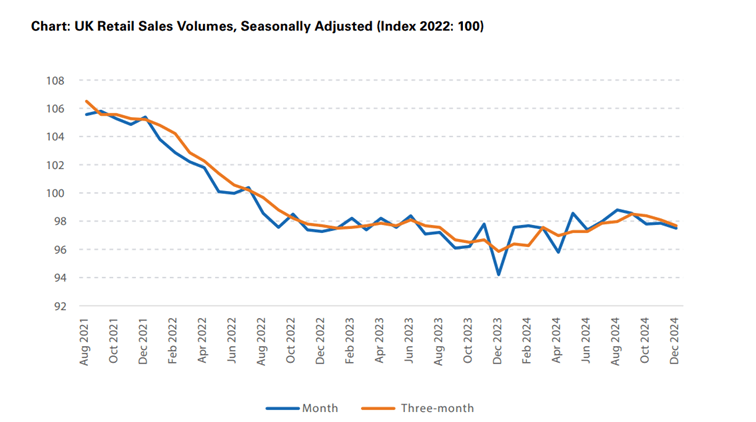

According to data from the Office for National Statistics (ONS), UK retail sales volumes have increased by 1.9% in the three months to December 2024. That said, performance has been disappointing since mid-2024 and the December reading was down by 0.3% against November. Overall, there were conflicting messages coming out of UK retail during the important final quarter of the year (dubbed the Golden Quarter as it contains Black Friday and the Christmas shopping period). While Asda, Primark and WH Smith reported disappointing year end sales, M&S, Tesco, Sainsbury’s, Curry’s, Next and Boots fared better. Overall, footfall on high streets, retails parks and shopping centres was down by 2.2% against prior year in December, according to data from the British Retail Consortium (BRC)1.

Source: ONS

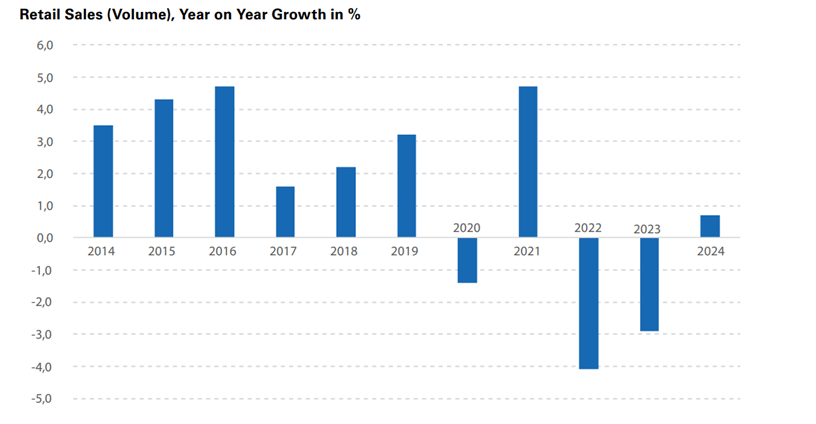

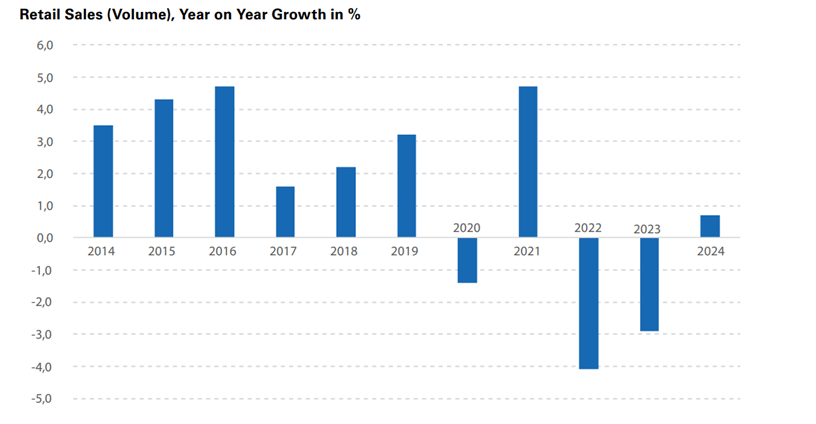

For the year as a whole, retail sales data also sends mixed messages. Positively, following two years of contraction, sales figures have increased for the first time since 2021. That said, the 0.7% expansion recorded in 2024 was rather soft, given the generally good macroeconomic backdrop which, at least in the first half of the year, included an increase in consumer confidence, robust wage growth and a drop in inflation. Also problematically, despite the upturn in 2024, retail sales volumes are still 2.5% below their pre-Covid reading2.

Source: ONS

More detailed data from the ONS reveals that three of the four most important retail sub-sectors reported sales growth last year: nonfood stores (+1.2%), non-store retailing (+3.2) and automotive fuel (+3.8%) saw increases while food stores (down by 1.2%) recorded a decline.

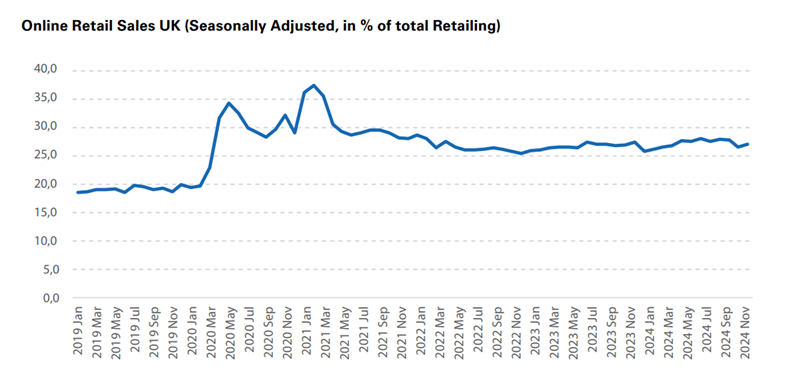

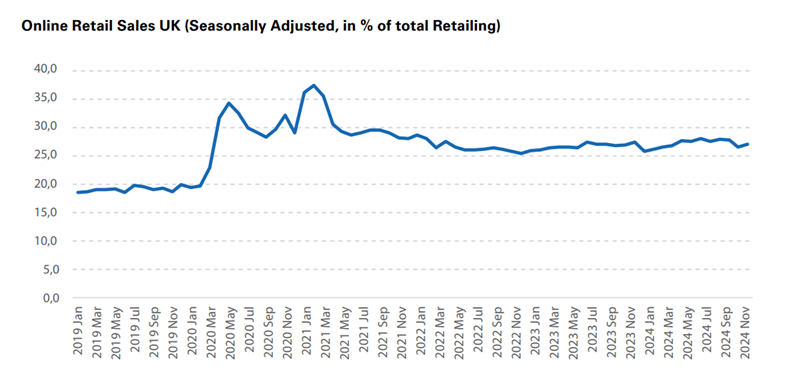

Online Sales

Online sales still account for more than a quarter of all UK retail sales. Having increased to levels above 30% during the Covid years in 2020-22, e-commerce had lost some ground to bricks-and-mortar shops again in the immediate aftermath of the pandemic. In December 2024, online retail sales (in % of total retail sales) came in at 27.0%, up from November (26.5%) but down from 27.4% twelve months ago. Data from debit and credit card company Visa also shows an increase in online retail: in December, total spending on Visa cards in the UK was up by 2.3% y/y with online shopping reporting 6.1% growth3.

Source: ONS

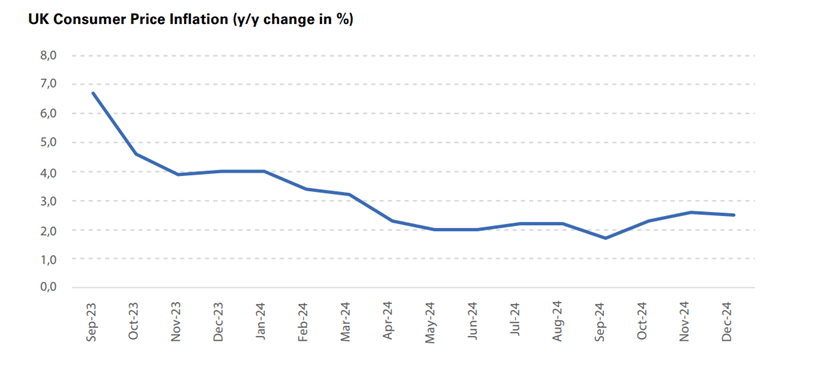

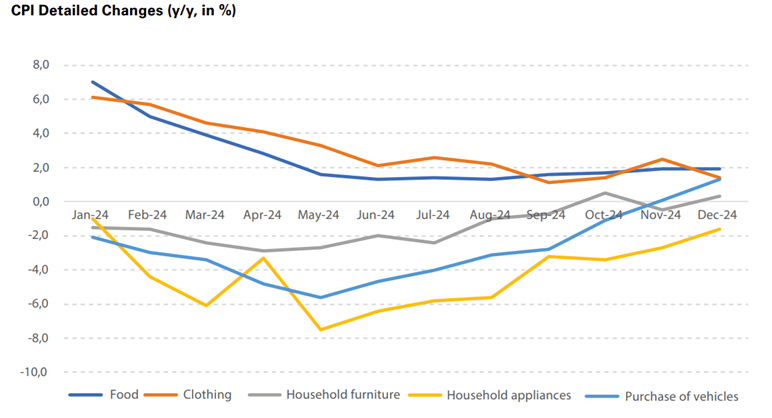

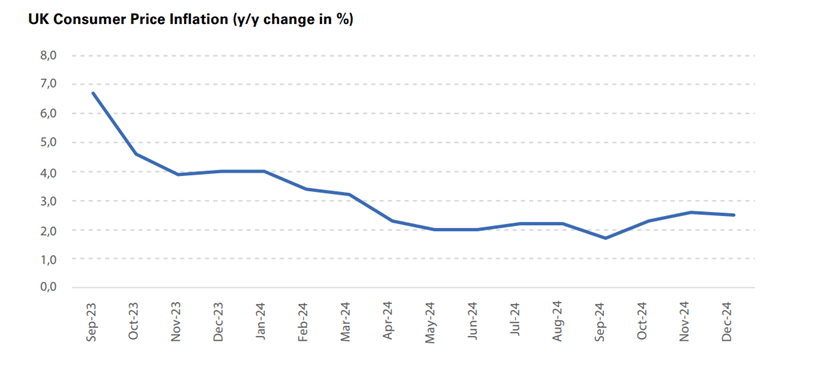

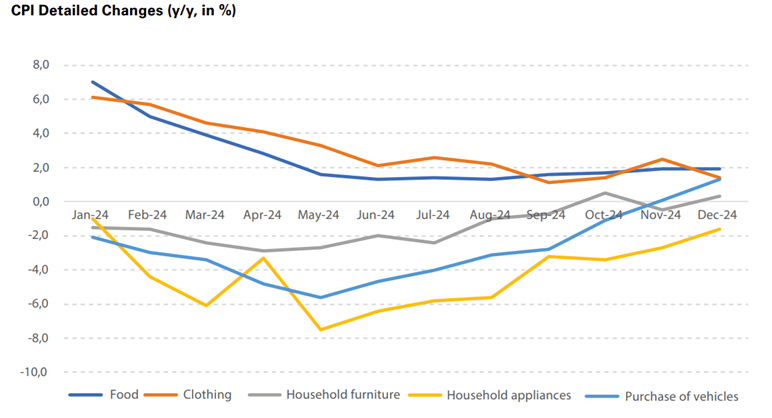

Inflation

Encouragingly for British households and businesses alike, inflation has maintained its downward trajectory in 2024 and fell below the Bank of England’s (BoE) 2% target in September (for the first time since mid-2021). Since then consumer prices have picked up again, reaching 2.5% in December. Core inflation (which excludes food and energy prices) stood somewhat higher, coming in at 3.2%, thereby highlighting the underlying pressures on consumer prices in the UK.

Source: ONS

A more granular breakdown of the most recent ONS statistics highlights that inflation continues to be service sector driven: while goods inflation stood at a low 0.7% in December, services inflation reached 4.4%4. Especially education (+5.0% y/y in December), health (up by 5.6%) and communication (+6.1%) continue to show elevated price pressures. That said, service sector inflation has been trending downwards in the final quarter of the year, goods inflation (which had been negative between April and October) moved higher in the final four months of 2024.

Source: ONS

Looking ahead, inflation is forecasted to stay above the BoE’s 2% target rate for longer than initially expected. Because of base effects, consumer prices could temporarily increase to 3.7% in the first half of 2025, according to the Bank’s Monetary Policy Report from 6 February5. Regardless, interest rates are still likely to be cut several times this year as economic momentum is weak and upward pressure on prices should diminish in the second half of the year.

Worryingly, food price inflation is also set to pick up again over the next months. After having reached levels of around 2% in late 2024, the Institute of Grocery Distribution forecasts food prices to increase by 2.4% to 4.9% in 2025. This is caused by higher national insurance contributions, a rise in labour costs, an increase in packaging costs and more regulatory burden as a new, final round of post-Brexit checks will have to be implemented in July 2025.6

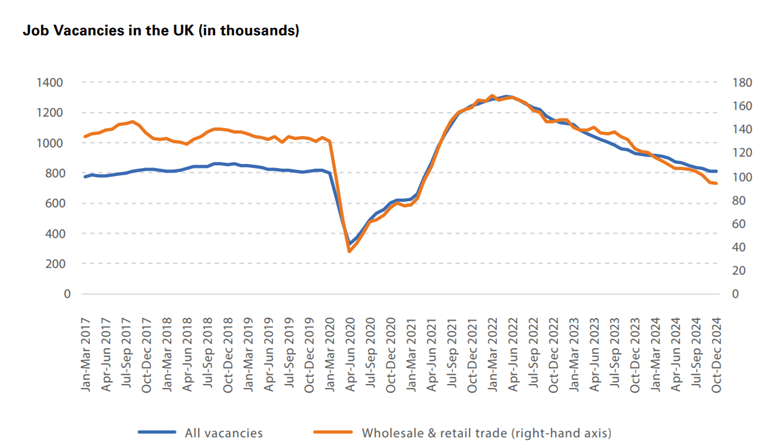

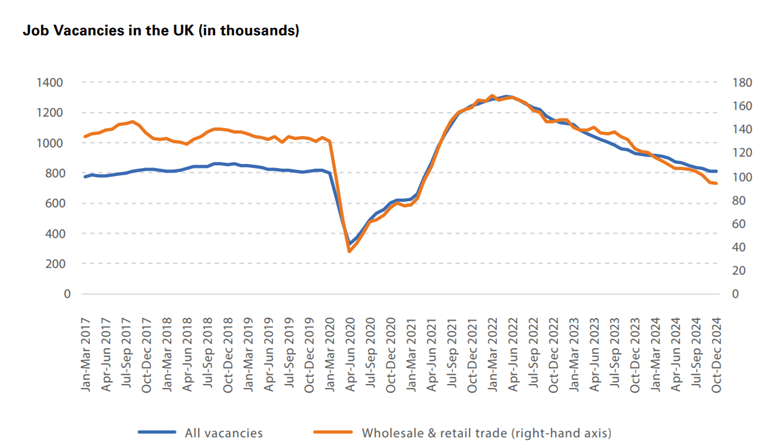

Labour Market

The retail sector remains an important factor for the British economy. In 2024, it employed around 2.87m workers (10% of all jobs in the UK), turned over GBP429bn and created around 9% of gross value added in the UK7 . Although 2024-employment stood slightly above the 1977-2023 average of 2.77m, the sector has lost a sizable number of workers last year. Around 170,000 retail sector jobs were shed in 2024, 42% more than in 2023 and the highest reading since 2020 (when Covid caused 200,000 layoffs)8.

The general slowdown of the sectoral labour market is also visible in the amount of open positions9. ONS data for October to December 2024 shows that the number of job vacancies in the wholesale and retail sector has dropped to 94,000, down from a peak of 169,000 in January-March 2022 and the lowest reading since 2011. The vacancy ratio (measuring the amount of open positions per 100 employee jobs) in the sector has also come down: from 3.8 in early 2022 to now 2.1, slightly below the national average of 2.5.

Source: ONS

Problematically for the sector’s profitability, labour costs have risen severely in 2024, despite the labour market slowdown and the fall in inflation. Between December 2023 and November 2024, weekly earnings growth (including bonuses and arrears) in the sector averaged 8.1% y/y. This was the third highest expansion rate across the 24 sectors surveyed by the ONS.

Source: ONS

Over the next quarters, wage growth at the higher end of the salary spectrum should moderate somewhat as inflation has cooled down and labour market conditions are likely to deteriorate further. At the same time, an increase in the minimum wage (see Politics chapter below) in April 2025 will provide upward pressures on wages of entry-level and low-skilled positions and eat into retailers’ profit margins.

2025 Outlook

Problematically, the outlook for the retail sector will be challenging as companies are likely to face ongoing cost pressures and lower-than-initially-expected demand. The macroeconomic backdrop will not improve by as much as initially expected, thereby also creating problems. Long-term trends such as ESG and AI implementation will also pose challenges (but also offer opportunities).

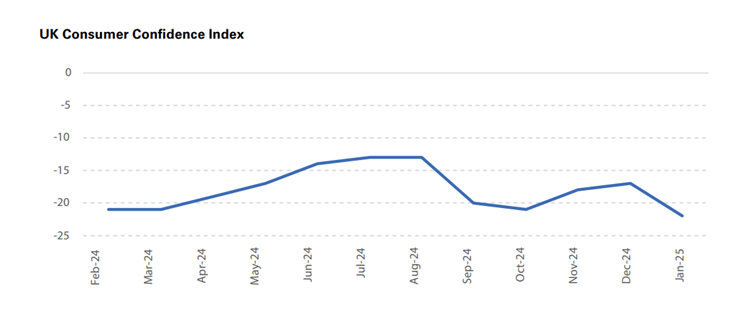

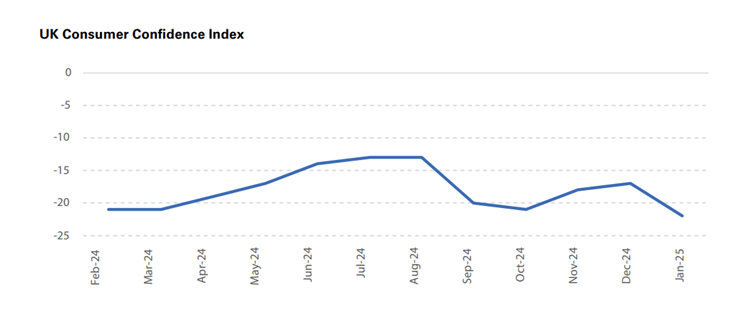

Macroeconomics

The UK’s outlook has clouded substantially over the past months. The BoE has halved its real GDP growth forecast to 0.8% in its Monetary Policy Report from 6 February as the UK is severely exposed to a potential trade war with the US. Overall, the US is the UK’s second most important trading partner (after the EU). In 2023, around 22% of all British export went to the US, representing around 7% of domestic GDP. Although 70% of British exports to the US are services (and hence not exposed to goods tariffs), the general uncertainty caused by the re-election of Donald Trump as US president will provide a drag on investment in the UK and also supress British exports across the Atlantic. While a weaker pound sterling will improve the UK’s international price competitiveness, the overall effect of potential US tariffs on the British economy will be negative10

Source: GfK

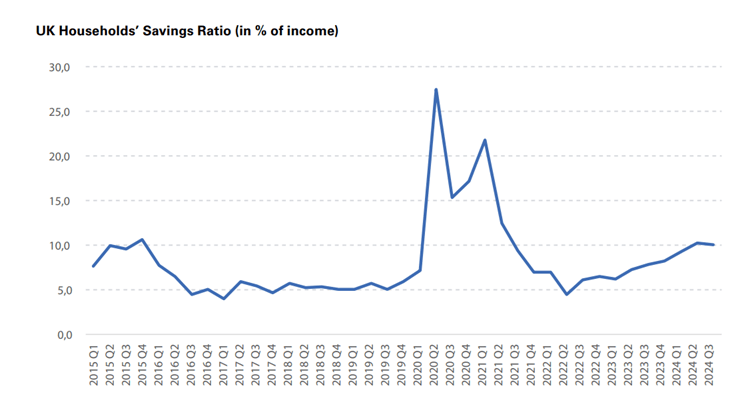

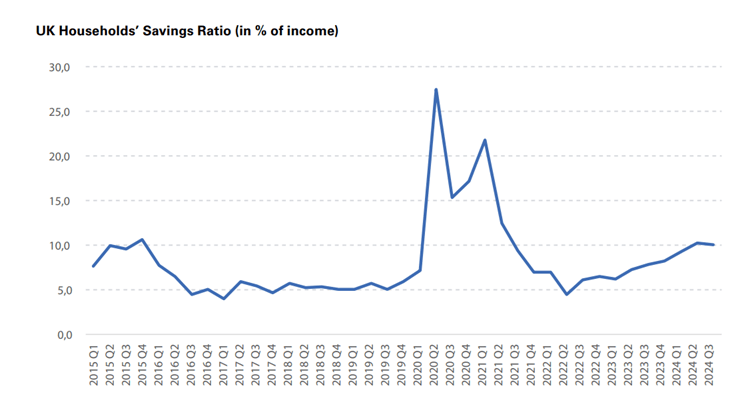

Equally problematically, UK retail is also exposed to the gradual decline in consumer confidence since autumn last year. While GfK’s Consumer Confidence Index had been on a steeply improving trend in 2023 and the first eight months of 2024, the situation changed in September when it fell from -13 points to -20. Since then it has moved largely sidewards, coming in at -22 points in January 202511. Compared with one year earlier (when the Index stood at -19 points), the major purchases sub-index is unchanged (-20) while the economic expectations sub-index is severely down (-34 versus -21 points in January 2024). Coinciding with the gloomy expectations, households’ savings ratio in the UK is elevated at the moment. According to ONS data, consumers are currently putting around 10% of their income aside, roughly twice the rate seen in 2017-2019 (the 2020-2022 period is distorted by Covid)12. As households’ precautionary savings are likely to remain high, the retail sector will face ongoing consumption constraints throughout 2025.

Source: ONS

Politics and Supply Chain Risk

Political risk had fallen in mid-2024 when the victory of the Labour Party ended 14 years of sometimes erratic Conservative rule. Elected with a comfortable parliamentary majority, the new administration embarked on a difficult journey to reduce the sizable fiscal deficit. Unfortunately for the retail sector, the government’s Autumn Budget included several measures that will create additional costs and thereby reduce profitability13.

Firstly, the increase in national insurance contributions (from 13.8% to 15.0% plus a lower threshold) and a higher minimum wage (from 11.44 pounds per hour to 12.21 pounds in April 2025) will lead to higher wage costs at a time when salaries had already risen substantially. Secondly, the higher plastic packaging tax from October 2025 on is expected to cost retailers an additional GBP2bn. Thirdly, business rate relief (introduced during the pandemic) will continue to be phased out, albeit by a slower pace than initially communicated. From April 2025 on, relief will drop to 40% (down from 75%) before being abolished completely in April 2026, one year later than previously announced. As a result of the incoming changes, an average high street shop will see its business rates climb from currently GBP3,589 to GBP8,613 in April 2025, according to property group Altus14. Although business rate reform still officially features on the government’s agenda it seems unlikely that the topic will be given priority, given the tight public finances. Taking all Autumn Budget policy announcements into account, the BRC expects operating costs in the sector to increase by GBP7bn per annum, a severe blow to the sector’s profit margins15.

Worryingly, further tax increases over the parliamentary term cannot be ruled out, given the precarious state of government finances. Borrowing stood at a four-year high in December 2024, the overall debt level is at a very high 100% of GDP and at the same time, government bond yields have risen substantially16. Should the government implement a new round of tax increases, the sector is likely to be hit directly (via higher operating costs) and indirectly (via lower household consumption).

Positively, supply chain risk has fallen somewhat in the second half of 2024 and transportation costs have decreased. Drewry’s World Container Index has dropped from USD5,937 per 40 foot equivalent unit in mid-July 2024 to USD3,273 in early February 2025. In y/y terms, the Index is down by 14% with the important Shanghai to Rotterdam connection seeing a 29% y/y fall17. The end of the Israel-Hamas war in Gaza and generally more stable conditions in the Middle East have the potential to further reduce transportation costs in 2025. Although major shipping companies are currently still avoiding the Suez Canal because of security concerns caused by the civil war in Yemen, a return to normality could be on the cards18.

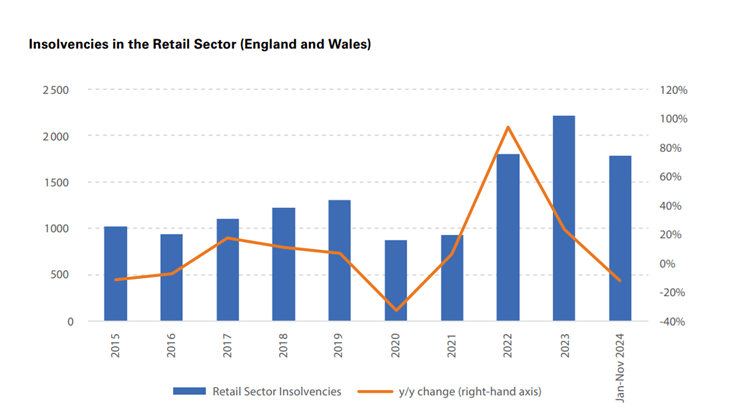

Credit Risk

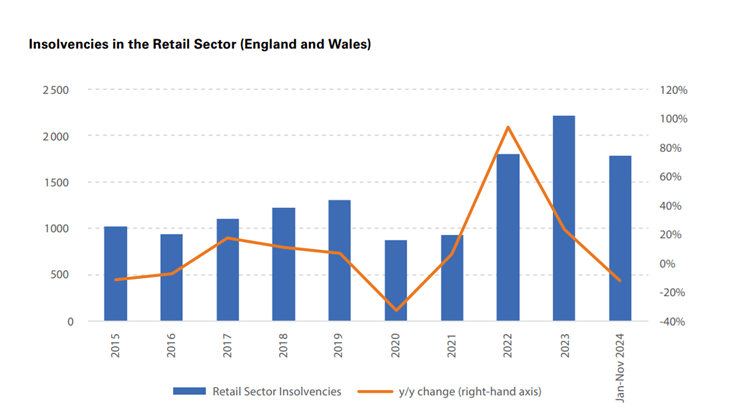

Encouragingly, insolvency risk in the UK has moderated in 2024, following three years of sizable increases. On the back of base effects, subdued economic growth, high inflation and tight monetary policy, bankruptcies in the UK had risen in 2021-23, reaching a 30-year high in 2023 when around 25,000 companies in England and Wales had to file for insolvency. The retail sector followed the national trend, recording 2,219 bankruptcies in 2023, up from 1,307 before Covid.

In 2024, 38 large retailers went under, according to the Centre for Retail Research19. This included stalwarts like Carpetright, CTD Tiles, Homebase, Lloyds Pharmacy, Ted Baker and The Body Shop. Positively, data from the UK government’s Insolvency Service shows that the overall number of business failures has fallen in January to November 2024 (December data has not been released yet). During the above-mentioned period, company insolvencies in England and Wales fell by 5% y/y (to around 22,100) while the retail sector reported an even bigger drop of 12%20.

Source: Insolvency Service

The improvements seen in 2024 were spread evenly across the retail sectors with eight of the nine sub-sectors recording a y/y decrease in insolvencies. Problematically, the credit risk outlook is still negatively impacted by tight lending conditions, a softer macroeconomic outlook and, although on a falling trend, relatively high interest rates. According to restructuring specialist Begbies Treynor, the amount of British retail companies in financial distress has increased by 37.4% y/y (food & drug retailing) to 47.6% (general retailing) in Q4 2024, indicating further problems ahead, especially in the light of the measures announced in the Autumn Budget21.

Long-term Trends

Looking ahead, the sector will continue to see pressure on its operating models. Much needed investment in artificial intelligence and online presences, including augmented reality will continue to require sizable funding but could also lead to higher revenues because of a more personalised shopping experience. The investment will adversely impact on profits, at least over the short- to medium run. Improved omnichannel experiences (providing a seamless shopping experience across all channels, from store to mobile and online) will also be key to maintain current and attract new customers.

While ESG topics have become less important for customers during the cost of living crisis, rising real wages (which are increasing households’ budgets) might prompt shoppers to pay more attentions to sustainability and societal topics again. Energy-efficiency is also becoming an increasingly important topic for consumers as energy costs have not dropped back to pre-crisis levels again. Additionally, supply chain management (e.g. ensuring that no child labour is used at suppliers) and sustainability are likely to feature heavily in the sector’s in-tray over the next years.

Furthermore, UK retail will also be impacted by a change in consumer habits. Shoppers, especially younger ones are increasingly eager to spend on experiences (such as holidays and entertainment), rather than material goods. Luxury goods and consumer durables are hence under pressure on several fronts: higher spending on services, increased households’ savings rates and still elevated food and energy costs (compared with pre-Covid years) which all undermine budgets for big ticket items.

[1] https://www.theguardian.com/business/2025/jan/03/drab-december-uk-high-street-decline-retail-footfall-sales

[2] https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/december2024

[3] https://www.theguardian.com/business/2024/dec/23/uk-shoppers-spending-more-high-street-than-last-christmas

[4] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/december2024

[5] https://www.bankofengland.co.uk/monetary-policy-report/2025/february-2025

[6] https://www.reuters.com/world/uk/uk-food-inflation-could-hit-nearly-5-2025-says-industry-researcher-2024-12-12/

[7] https://www.reuters.com/world/uk/uk-food-inflation-could-hit-nearly-5-2025-says-industry-researcher-2024-12-12/

[8] https://www.theguardian.com/business/2024/dec/29/nearly-170000-uk-retail-staff-lost-their-jobs-this-year-data-shows

[9] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/jobsandvacanciesintheuk/january2025

[10] https://www.bankofengland.co.uk/monetary-policy-report/2025/february-2025

[11] https://nielseniq.com/global/en/news-center/2025/uk-consumer-confidence-down-five-points-to-22-in-january/

[12] https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/dgd8/ukea#

[13] https://www.knightfrank.com/research/article/2024-11-08-the-retail-note-autumn-budget-a-triple-whammy-for-retail

[14] https://moneyweek.com/economy/small-business/business-rates-relief-to-be-slashed

[15] https://www.theguardian.com/business/2024/nov/19/uk-retailers-rachel-reeves-budget-tax-rises-brc

[16] https://www.bbc.com/news/business-50504151

[17] https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry

[18] https://www.agbi.com/logistics/2025/02/egypt-urges-return-of-suez-canal-traffic-after-gaza-ceasefire/

[19] https://www.theguardian.com/business/2024/dec/29/nearly-170000-uk-retail-staff-lost-their-jobs-this-year-data-shows

[20] https://www.gov.uk/government/statistics/company-insolvencies-december-2024

[21] https://www.begbies-traynorgroup.com/news/business-health-statistics/historic-jump-in-the-number-of-firms-in-critical-financial-distress