Positively for producers, prices for hot-rolled coil steel have increased in the first quarter of 2024, following a disappointing second half of 2023. Fastmarkets’ daily steel hot-rolled coil index, domestic, ex Northern Europe averaged EUR721 per tonne in Q1 2024, compared with EUR651 only in Q4 2023. That said, price increases were rather small, that maintains pressure of producers’ and service centres’ profit margins.

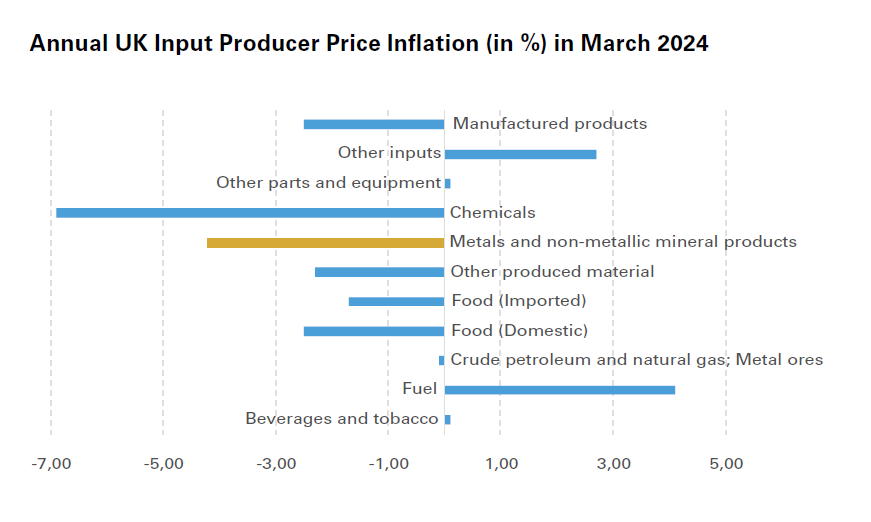

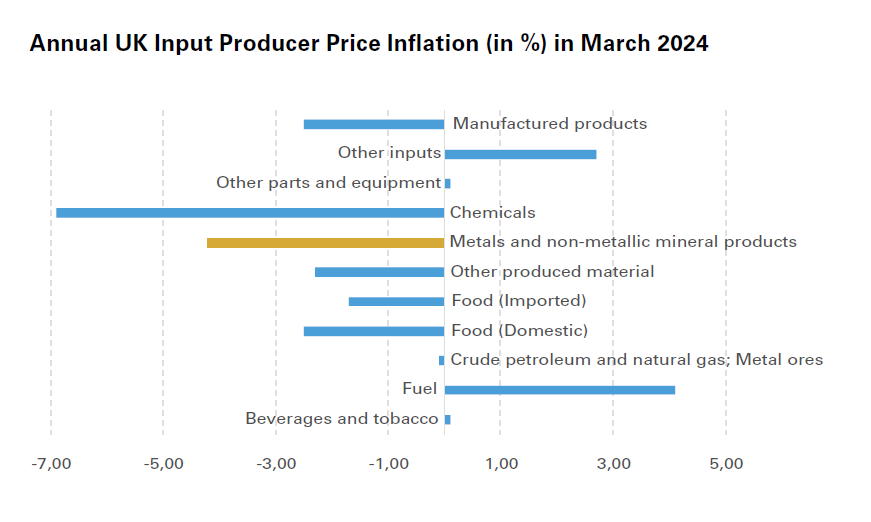

Encouragingly in this light, input producer price inflation (PPI) in the sector has maintained its downward trajectory in early 2024. According to latest available data from the Office for National Statistics (ONS), input producer prices for metals and non-metallic mineral products fell by 3.8% year on year (y/y) in February and by an even higher 4.2% in March, thereby outperforming the national average (-2.5% y/y in March) and all other manufacturing sectors bar chemicals (-6.9%). Largely driven by cheaper energy costs, lower commodity prices and base effects, falling PPI helps metal producers to keep their input costs at bay.

Source: ONS

End users

The UK manufacturing sector has seen output growth in 2023, according to latest ONS figures. Industrial production increased by 1.1% last year, compared with a 3.3% contraction in 2022. Positively, manufacturing outperformed many other industries last year with mining and quarrying (-13.7%), oil and gas extraction (down by 14.8%) and electricity, steam, gas and air conditioning (-1.9%) all posting falling output levels. Also encouragingly, output growth in the British manufacturing sector maintained its good momentum in the first quarter of 2024: monthly figures increased by between 1.4% and 2.6% y/y in January-March.

A more detailed breakdown of industrial production figures reveals that most metal-consuming or metal-producing sectors have seen improving operating conditions over the past quarters. Output in the basic metals and metal products sub-group has been rising (in y/y terms) since mid-2023, averaging almost 8% growth in the May 2023 to March 2024 period. Transport equipment output has been rising since October 2022, averaging 15% growth in 2023 and an even higher 22% y/y in Q1 2024. Machinery production output remains on a downward trajectory however:- having fallen in ten out of twelve months in 2023 (average contraction: 4%), January-March 2024 has seen additional drops of between 7.5% and 12.2% y/y.

Source: ONS

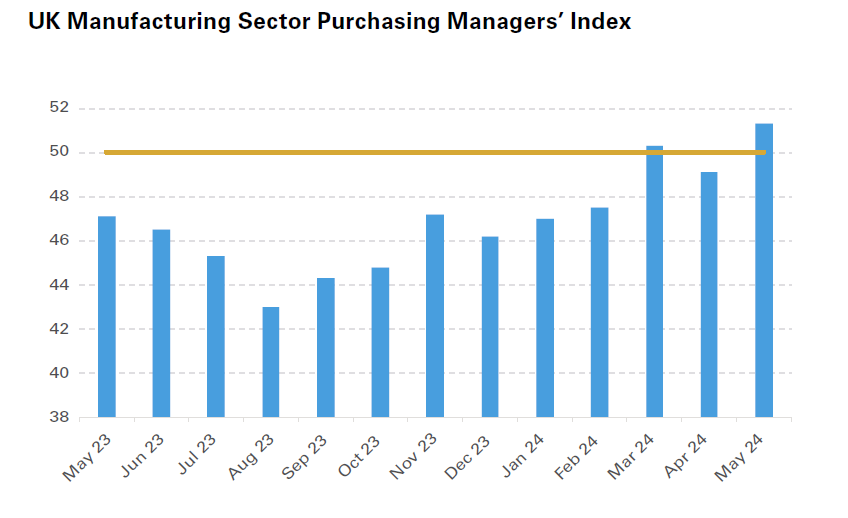

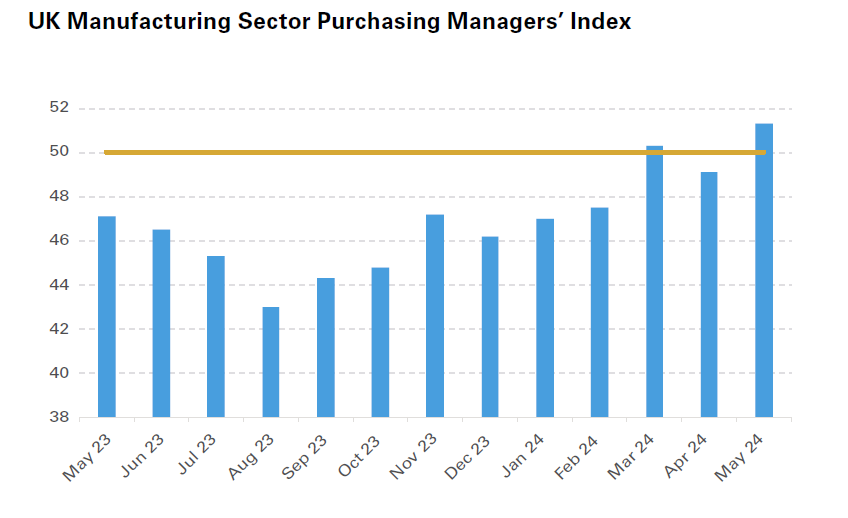

The surprisingly robust output growth figures are at odds with sectoral confidence indicators though. In the June 2023 to May 2024 period, the UK Manufacturing Sector Purchasing Managers’ Index (PMI) stood below the neutral 50-points line (which divides optimism from pessimism) in ten out of the twelve months covered. Positively, the most recent data point from May 2024 (51.3 points) is the highest in since July 2022 and the production sub-index came in on the best reading since April 2022, pointing towards a slightly improved outlook for the UK manufacturing sector.

Source: S&P, range: 0 (pessimism) to 100 (optimism), neutral reading: 50 points

Labour Market

Employment in the UK steel industry has been on a steeply downward trend for several decades now, falling by around 90% over 1970-201. By 2023, the number of people directly employment in the steel industry had dropped to below 40,000, according to industry body Make UK . Looking ahead, jobs are likely to be shed further. In January 2024, India-based Tata Steel, the UK’s biggest steel producer announced to cut 2,800 jobs (out of a total 8,000 in the UK) over the next three years. The majority of them (2,500) will occur in their Port Talbot facility over the next 18 months. The shift towards new, greener production methods is impacting on the workforce on sizable scale with requested government subsidies (see Politics chapter in the Outlook section) potentially minimising future job losses.

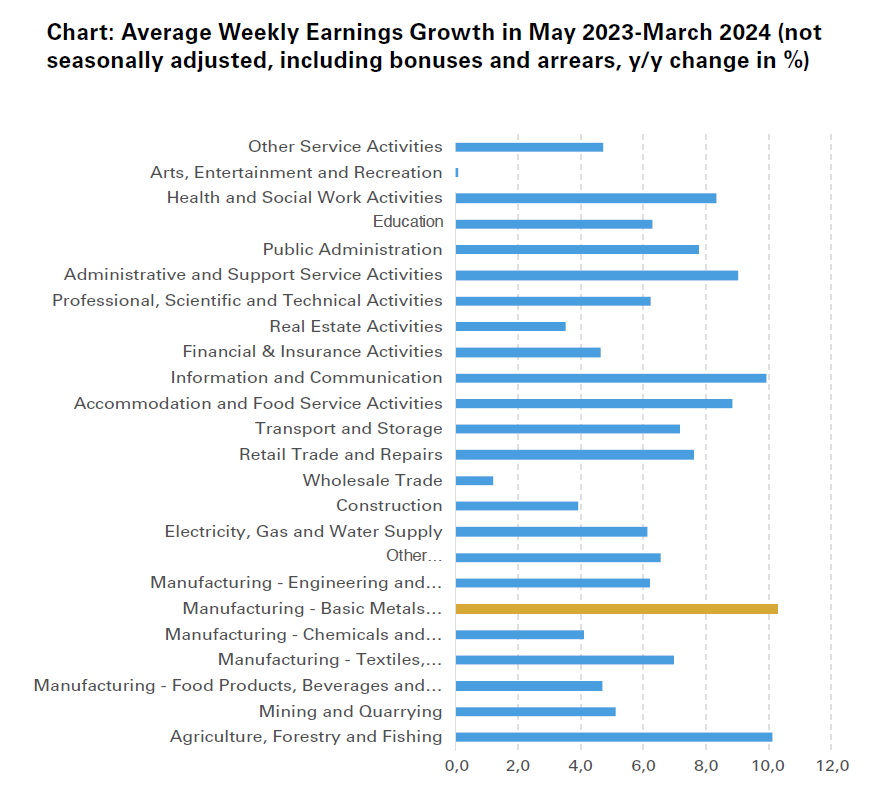

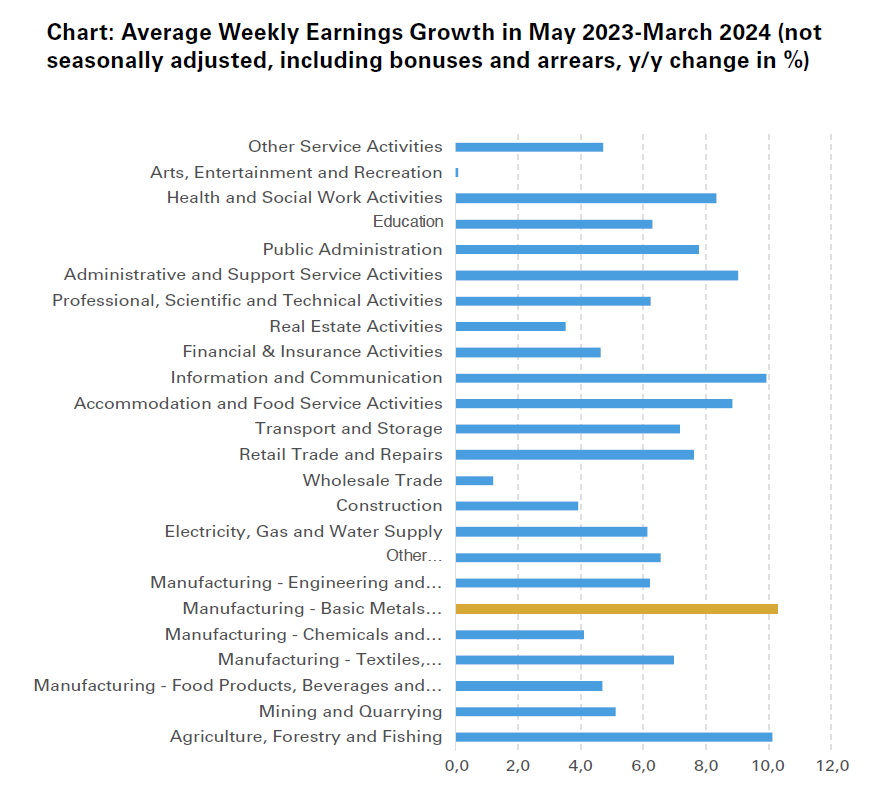

Generally, labour market conditions in the UK have deteriorated slightly over the past quarters: (nominal) wage growth has moderated, the number of job vacancies has fallen, employment has stalled and unemployment has gone up slightly. In the manufacturing sector, the picture is somewhat more balanced however. Indeed, the sector has not been immune to some negative trends:- the number of job vacancies has dropped from 75,000 in February-April 2023 to 61,000 one year later and nominal wage growth has also moderated in Q4 2023 and Q1 2024. That said, with an average y/y growth of 10.3% in May 2023 to March 2024, average weekly earnings growth in the basic metals and metal products sub-sector increased by the fastest pace amongst all 24 industries covered by the ONS.

Source: ONS

Also positively, the manufacturing sector bucked the national trend in Q1 2023-Q1 2024: while employment in the UK fell by 0.7% y/y, manufacturing reported a small increase (+1.5%). However, a long-term comparison paints a gloomier picture, mirroring the above-mentioned employment statistics for the UK steel sector: while in 1997, 17% of the UK workforce was still employed by the manufacturing sector (4.4m out of 26.2m), this share has now dropped to 8% (2.7m out of 33.0m in Q1 2024).

Outlook

Looking ahead, the sector will continue to face several challenges, from the fallout of the general election (which creates uncertainty from a political risk point of view) to macroeconomic conditions and a still elevated level of credit risk. Positively, operating conditions are set to improve somewhat in the second half of this year, something that is already visible in improving confidence indicators.

Macroeconomics

Encouragingly, the British economy has pulled out of recession in early 2024. After real GDP had contracted in quarter on quarter (q/q) terms in Q3 and Q4 2023 (by 0.1% and 0.3% respectively), growth rebounded strongly in January-March. ONS data shows a 0.6% q/q expansion, translating into 0.2% y/y growth . Positively for the UK metals sector, a more detailed breakdown of GDP growth

figures highlights sound momentum. Out of the 13 manufacturing sub-sectors, 8 reported growth in Q1 2024. Best performers were transport equipment (+5.7% q/q, the sixth consecutive quarter of improvement) while manufacture of basic metal and metal products also grew by a sound 3.1%. Although machinery and equipment production continued to subtract from the overall manufacturing GDP output, Q1 2024 figures were much better than Q4 2023 data (-0.1% versus -0.5%)

Source: ONS

Also positively, optimism is not only growing in the UK manufacturing sector but also in construction (which, in Europe accounts for around a third of all steel consumption). The latest UK Construction PMI rose to 53.0 points in April, up from March’s 50.2 points and comfortably above the neutral 50-points line. Output grew by the fastest rate since February 2023 and although residential building work is still falling, commercial building activity expanded and new order inflow remained in growth territory for the third consecutive month. Problematically, confidence indicators in the neighbouring eurozone construction sector remain near rock-bottom though, thereby undermining export prospects of UK steel producers.

Taking the much bigger service sector (which accounts for around 80% of UK GDP) into account, the British economy is set to switch into a higher gear this year. Following its latest in-depth assessment of the British economy and on the back of the surprisingly good Q1 data, the IMF has lifted its 2024 real GDP growth forecast from 0.5% to now 0.7%. As UK consumer price inflation is finally approaching the Bank of England’s 2% target, interest rate cuts in the second half of 2024 and 2025 are likely. According to the IMF, interest rates will drop from the current 5.25% to 3.5% by the end of2025, thereby stimulating the economy with housebuilding as well as corporate investment likely to see a much-welcome stimulus.

For the British manufacturing sector, latest data from Make UK (which was published before the strong Q1 real GDP growth release though) shows that survey respondents expect a virtually flat 2024 (output growth: 0.1%). For 2025, the outlook is marginally better (+0.8%) but it is likely that the Q2 2024 survey will deliver a more optimistic outlook. Meanwhile, in the European steel sector, consumption is forecasted to grow by 3.2% in 2024, according to industry association Eurometal.

Furthermore, together with easing supply chain constraints, European aerospace and automotive companies are currently benefitting from geopolitical developments as well. Nearshoring and the prospect of higher tariffs on Chinese cars should hence boost demand for metals in Europe, including the UK. Indeed, latest domestic car production figures surprised on the upside: in Q1 2024, UK car output was up by 1.1% y/y, according to the Society of Motor Manufacturers and Traders . For the year as a whole, output of British car factories is still forecasted to shrink (by 6.2%, due to model changeovers) but with EV production coming on stream in 2025, production is projected to come in above the 1m unit threshold again (for the first time since 2019).

Politics and Regulatory Environment

The general election on 4 July 2024 is creating an additional layer of uncertainty for the UK metals sector (as well as for the wider economy). After fourteen years in power, the incumbent Conservative government is set to be ousted by the centre-left Labour Party. The consequences of such a change are difficult to predict and quantify but it seems likely that decarbonisation and investing in generally less energy-intensive production methods will have to remain a key priority for British steel makers.

Although the Labour Party has ditched its GBP28bn per annum green investment pledge in early 2024, citing affordability issues, it remains committed to a GBP3bn fund for the British steel industry . The money, which will be spent over five year and not, as initially intended, a decade should help to finance the costly move from blast to electric arc furnaces (EAF). This switch is required to maintain primary steel making in the UK due to the age and inefficiencies of the existing mills to remain competitive with Europe. The upgrade to EAFs are capital intensive, hence requiring government assistance not just on the initial outlay e.g. a GBP500m grant to Tata, but also in terms of surrounding infrastructure and scrap conservation. Positively, the UK creates enough scrap to feed all proposed and existing EAFs. As country is currently a net exporter of scrap, it is in a good position to be able to be self-sufficient on feed stocks. That said, there are limitations on the grades that can currently be produced by EAFs so further research is needed to ensure the UK can provide all products presently manufactured. European mills are also making steps to decarbonise so the UK will need to push on to ensure it is not left behind as low carbon costs are increasing to be specified in building and project parameters in the future.

Lastly, given the generally more EU-friendly credentials of the Labour Party, the potential change in government might also facilitate the smooth introduction of the British carbon border adjustment mechanism (CBAM) and its alignment with the EU’s scheme. In the UK, the incumbent government announced in December 2023 that it will launch its own CBAM, aimed at minimising carbon leakage.

Without harmonising starting dates (the EU’s scheme is likely to be fully implemented by 2026, the UK’s in 2027) and regulatory requirements (including which sectors will be captured), there are potential conflicts, especially in Northern Ireland given its open border with the Republic of Ireland.

Business failures

Credit risk in the UK remains very elevated, a trend likely to last into 2025. Data from the government’s Insolvency Service shows that England and Wales (Scotland and Northern Ireland publish separate data) registered 25,158 company insolvencies in 2023. This is a 14% increase against prior year, on top of (admittedly Covid-distorted) rises of 11% in 2021 and 57% in 2022 .

Source: Insolvency Service

In the metals sector the 2023-picture is mixed however:- while the number of business failures in the manufacture of basic metals and manufacture of fabricated metal products sub-sectors increased by a sizable 128% and 10% respectively last year, manufacture of machinery and equipment (-3%) and manufacture of motor vehicles (-11%) witnessed drops. It is important to note though that the four above mentioned sectors combined only accounted for 422 business failures, roughly 2% of the total England and Wales figure. In construction (which, as already mentioned, is also an important destination of UK metal production), the number of business failures increased by 5% in 2023. As construction accounts for around 17% of all company bankruptcies, this is a very problematic development. Looking ahead, slightly better economic growth, returning business confidence and interest rate cuts should help to bring credit risk downwards somewhat. Problematically however, lending conditions remain tight and although likely to come down over the next years, interest rates will remain far above the levels seen in 2009-2021, thereby complicating access to credit through 2025.