Wednesday 29 November 2023

- Thought Leadership

Trade Credit UK Economic Conditions Sector Report H2 2023

By Ray Massey

Summary

-

Consumer and business confidence indicators are contracting, reflecting widespread pessimism in the UK economy.

-

Growth in 2023-24 will be around 0.5%-0.6% per annum, according to the latest IMF forecasts with the UK projected to be the worst performing G7 economy in 2024.

-

Inflation has come down from a 41-year high of 11.1% in October 2022 to 4.6% a year later. Further improvements are likely but at a much slower pace.

-

Interest rates are like to stay at their current levels for several months with small cuts in late 2024 possible but by no means certain as core inflation proves to be rather sticky.

-

The labour market is cooling down, but real wages have increased in 2023, with both trends set to continue into next year.

-

While UK B2B payments performance has improved somewhat in 2022-23, the number of business failures has increased considerably. We saw a 10% year on year increase in Q3 2023 so a further rise in credit risk in 2024 is very likely.

-

In this light (and on the back of a very real risk of recession), the need for appropriate counterparty checks and protection such as trade credit insurance heightens.

To view a pdf version, click here.

Economic Performance

At a top level, growth is slowing down in 2023 with UK households and businesses alike feeling pessimistic about the year ahead. Low confidence readings, despite the gradually subsiding cost of living crisis, will translate into an almost stagnant economy in 2024 and there are well-founded fears that the UK will fall into recession in the coming quarters.

Consumer Confidence

UK households were becoming less pessimistic as 2023 progressed on the back of falling inflation (see below) and the easing cost of living crisis with GfK’s Consumer Confidence Indicator gradually improving from -45 points in January to -21 in September. However, by October, escalating geopolitical tensions amidst the Israel-Gaza conflict and deteriorating economic data pushed consumer confidence back down to -30 points and the Major Purchase sub-index by a stark 14 points (down to -34).

Looking ahead, a slowing labour market and a sizable recession risk will continue to impact on the willingness of households to spend, especially on big ticket items. However, inflation is projected to come down and real wage growth remained in positive territory by mid-2023 so there is room for cautious optimism. On balance, in real terms, household spending should improve somewhat in 2024.

Business Confidence

Unfortunately, business confidence indicators reflect the widespread pessimism found in households. In the construction sector, the Purchasing Managers Index (PMI), compiled by S&P Global, stood at 45.6 points in October. Although this is slightly up from September’s 45.0 points, it is still below the neutral 50-point line that divides sectoral expansion from contraction. Worryingly, new order inflow has fallen for three straight months, indicating further trouble ahead.

The PMI in manufacturing also stands below the 50-points benchmark, producing a reading of 44.8 points in October. While this was a minor improvement on the previous month’s reading of 44.3 points, production fell for the eighth consecutive month, the longest period of contraction since the global financial crisis . Problematically, the four remaining sub-categories are also heading in the wrong direction, indicating increasingly challenging operating conditions across the sector. Pipeline problems are also becoming more and more evident as new order inflow has fallen for seven straight months.

In the service sector (which accounts for more than 70% of UK GDP), the situation is somewhat better as the PMI reading stands closer to the neutral 50-point line. Nonetheless, with a reading of 49.5 points, the sector has contracted for the third month in a row. While the service sector continued to weather the deteriorating economic conditions better than others, it is not immune to the challenges with the sectoral PMI deteriorating quickly since mid-year.

The reduction in new work was the quickest since November 2022, caused by lower domestic orders despite a slight increase in overseas demand. Employment levels are also falling, and the “volumes of unfinished work” sub-index decreased for the fifth consecutive month, suggesting that capacity in the service sector is increasingly plentiful. While prices for most raw materials are trending downwards, survey respondents mention substantial wage growth and high food and fuel prices as factors that are negatively impacting on sectoral performance. Positively and despite the plethora of negative developments, the share of companies expecting better operating conditions next year still exceeds the pessimists by a sizable margin (44% to 12%).

Real GDP Forecasts

Unsurprisingly, the broader lack of confidence is translating into poor GDP growth predictions. In its latest set of forecasts, the International Monetary Fund (IMF) expects real GDP growth in the UK to come in at 0.5% this year, an increase on April’s forecast of -0.4%. Unfortunately, while the Fund has upgraded the 2023 forecast by 90 basis points, it has revised its 2024 prediction for UK growth downwards from 1.0% to a meagre 0.6% next year.

While the UK is expected to be the worst performing G-7 economy in 2024, it has some company that isn’t too far away. Real GDP in the eurozone is expected to expand by only 1.2% next year with Germany, the region largest economy, dragging growth downwards. Dubbed the “new sick man of Europe”, the former powerhouse will only grow by 0.9%, up from a 0.5% contraction this year. Worryingly, there are clear challenges to European growth and future revisions to forecasts are likely. Already, the Bank of England (BoE) forecasts that the UK economy will stagnate until 2025 with momentum already clearly lost with real GDP flatlining in July-September. Although the BoE’s baseline scenario currently does not foresee a recession, a further deterioration cannot be ruled out amidst rising geopolitical tensions and the impossible-to-quantify adverse effects of the recent monetary tightening cycle.

Inflation

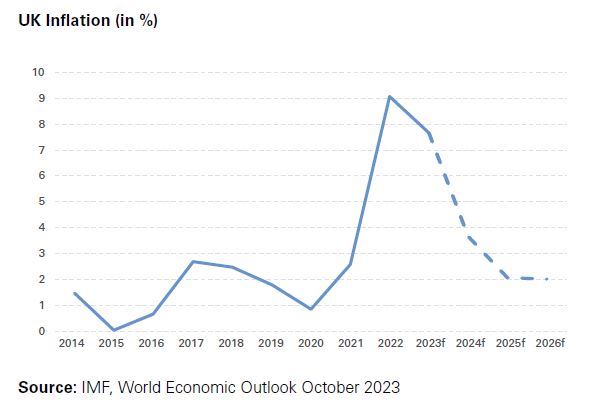

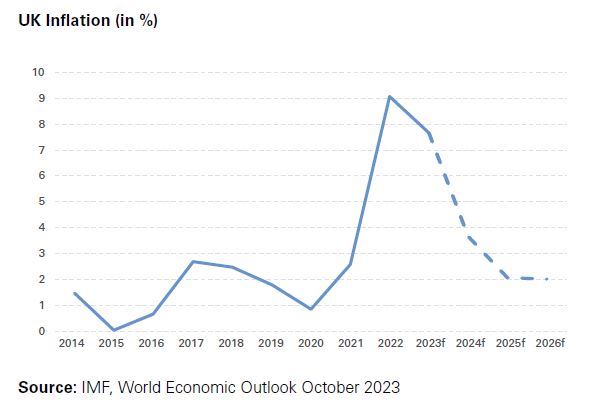

Positively for the country’s macroeconomic outlook, inflation has fallen throughout 2023 with further improvements, albeit at a smaller pace, forecast for next year. Due to rapidly rising commodity prices (including hydrocarbon), pent up Covid demand and ultra-lose fiscal and monetary policy, consumer price inflation skyrocketed in 2021-22. In the UK, the consumer price index (CPI) increased from 0.4% in February 2021 to 11.1% in October 2022, the highest reading in 41 years. As a response to CPI overshooting its 2% target rate by such an immense margin, the BoE embarked on a very aggressive monetary tightening cycle. Between November 2020 and August 2023, the Monetary Policy Committee has increased the key policy rate from an all-time low of 0.1% to 5.25%, the highest reading since early 2008.

Although this treatment has side effects, rising interest rates, together with falling commodity prices, have a calming effect on the CPI. After its peak of 11.1% in late 2022, inflation has moderated throughout 2023, reaching 4.6% in October 2023.

Problematically, core inflation (a concept that ignores energy prices and costs for unprocessed food) remains stubbornly high at 5.7%, highlighting some entrenched inflationary pressures in the British economy. Looking ahead, the IMF predicts consumer price inflation in the UK will trend downwards in 2024-25 but at a much slower pace. From an average of 7.7% in 2023 (exceeding the eurozone average of 5.6% by a sizable margin), UK inflation will drop to 3.7% in 2024. For 2025, the IMF expects an average inflation rate of 2.0%, in line with the BoE’s target.

That said, because of the higher than expected wage growth and rising commodity prices, central bankers around the globe have recently revised inflation forecasts upwards again with the BoE warning that “inflation will be higher for longer”. Although the Bank has not raised interest rates since August 2023, another 25-50 basis points hike in late 2023 or early 2024 to fully arrest inflationary pressure cannot be ruled out. That said, given the slowing economy and the generally downward trend of inflation, a small rate cut in late 2024 seems to be a more realistic scenario.

UK Labour Market

Unemployment Rate

As the UK economy switches into a much lower gear, the UK labour market looks to be following suit. In the three months to October 2023, the number of job vacancies dropped by 58,000 to 957,000, the sixteenth consecutive quarter vacancies have declined. The most recent data shows that the downturn is widespread with 16 of the 18 sectors surveyed by the Office for National Statistics (ONS), recording a smaller number of open positions. And when compared to the previous year, the decline is even more visible with job vacancies down by around 260,00 but still 130,000 above pre-Covid readings.

According to the latest available data from May-July, the unemployment rate remained stable at a still low 4.3%. However, against the previous three-month period, the figure has increased by 0.5 percentage points, also above the pre-Covid reading of 4.0%. Employment figures are also gradually deteriorating with the employment rate in May to July standing at 75.5%, down 0.5 percentage points against the previous quarter and 1.1 percentage points below pre-Covid records.

Wage Growth

While the labour market slowdown has resulted in a smaller number of vacancies and higher unemployment rates, it has not yet translated into lower wage growth. In the three months to September, regular pay increased by 7.7% , slightly down on the previous period but still one of the highest rates since the ONS launched the data series in 2001 . Average total pay (which includes bonus payments) stands at an even higher 7.9% but that figure is somewhat inflated by one off payments in the civil service. In fact, in July to September, the public sector saw regular pay growth of 7.3%, the highest rate ever recorded. In the private sector, the corresponding figure was even higher at 7.8%, one of the fastest annual growth rates witnessed by the sector outside the Covid period.

The purchasing power of UK households may be set to increase as real wages (nominal wages minus the inflation rate) rose for the fifth consecutive time in the third quarter. Nominal wage growth was too weak to compensate for the very elevated inflation rates in April 2022 to April 2023, leading to negative real wage growth but the drop in inflation has once again pushed growth rates into positive territory . That said, developments are very heterogeneous with certain sectors of the British economy still experiencing a fall in real wages. The most recent data from the ONS shows that sectoral pay increases range from low (3.7% in arts, entertainment and recreation) to relatively high (11.5% in basic metals and metal products manufacturing).

Looking ahead, labour market conditions are set to deteriorate somewhat as economic growth will be weak. Wage growth will see the usual delayed response but given the still sizable labour shortages and the enduring demographic changes, salaries will continue to rise at a robust pace with real wages set to rise further in 2024 if inflation continues to fall. While this will help to support domestic demand, conversely it will cause problems for companies due to higher input costs.

Exchange Rate

Compared to last year, Sterling has appreciated by more than 5% against the US dollar but much of this upward movement occurred in Q2 2023. Since then, the pound has lost some ground against the dollar, falling from 1.30 to 1.25 Dollars to the Pound in mid-November. Interest rate differentials are unlikely to play a role in future exchange rate movements as both central banks have recently stopped increasing key policy rates and are likely to implement similar monetary policies in the future. Forward rates range close to the current exchange rate of 1.25 Dollars to the Pound , indicating little change in the twelve months ahead. That said, political events (elections will take place in both countries in late 2024 or early 2025) have the potential to impact on the exchange rate in a significant way.

Credit Risk

Generally speaking, the risk of non-payment in the UK (as well as the wider European region) has increased through the course of 2023. With interest rates remaining elevated and growth falling to anaemic and potentially negative levels, this worrisome trend is likely to continue in 2024.

Payments Performance

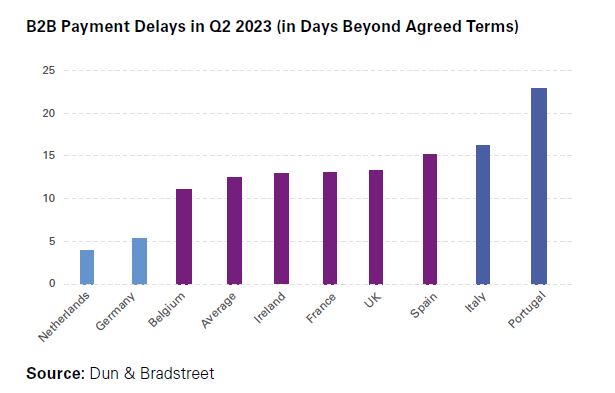

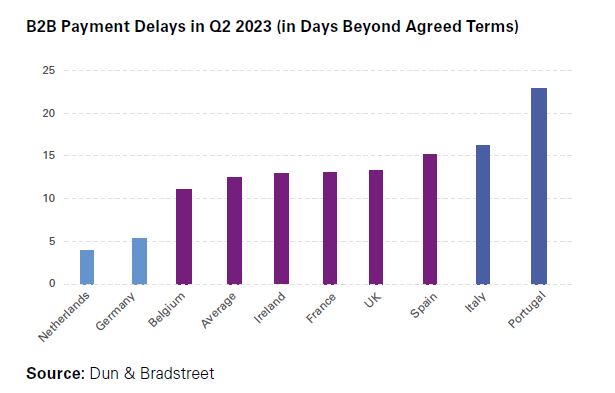

Positively, B2B payments performance data from business information provider firm Dun & Bradstreet illustrates that UK-based companies are paying suppliers in a timelier fashion than they were a year ago. Latest records for Q2 2023 show that the average payment delay stood at 13.3 days beyond agreed terms . This is down from the 14 days seen at the end of 2022 and even slightly below the last pre-Covid reading of 13.4 days in Q4 2019. That said, the UK still compares unfavourably against a European average (which also deteriorated) of 12.5 days in the April to June period. Over the past fifteen years, B2B payments performance in the UK has steadily deteriorated, leaving the country trailing the top nations Germany and the Netherlands and keeping company with the lower mid-table countries. Positively, the UK still outperforms the Mediterranean countries which remain firmly anchored to the high-risk end of the table.

Business Failures

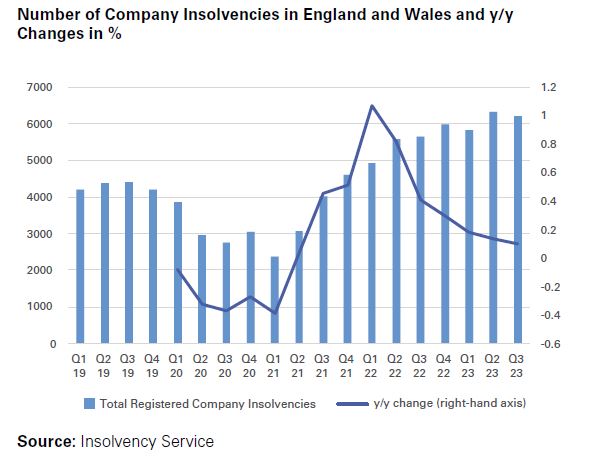

However, this relative positivity does not translate into an encouraging business failure rate. The UK’s performance is already starting to deteriorate which isn’t too surprising, given the plethora of headwinds companies faced this year. Lower growth and disposable income, higher input costs, rising interest rates (in order to fight inflation) and the obligation to repay Government support received during the Covid pandemic, have all created significant obstacles for businesses.

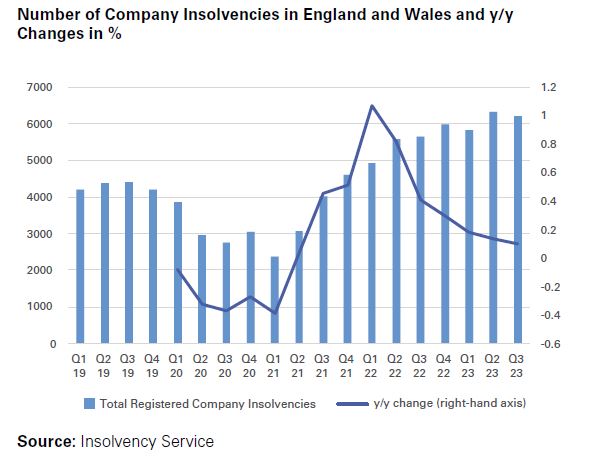

As a result, the latest data from the UK Government’s Insolvency Service shows steep increases in the number of bankruptcy registrations in Q3 2023 . England and Wales recorded 6,208 seasonally adjusted bankruptcy declarations in July to September, up by a sharp 10% on last year. Scotland (up 7% with 296 bankruptcies) and Northern Ireland (a 24% increase with 64 business failures) have also seen sizable deteriorations. In England and Wales (which account for almost 95% of all business failures in Q3), the liquidation rate in the four quarters to September 2023 stood at 52.4 per 10,000 active companies, meaning that one out of every 191 companies entered liquidation in Q4 2022-Q3 2023. This is up from a much lower reading of 46.9 per 10,000 one year earlier.

The increase in business failures in Q3 comes on top of similar developments in recent quarters. Company insolvencies in England and Wales have been rising year on year since Q2 2021 and in overall terms, figures now exceed the pre-Covid records by a sizable margin.

A sectoral comparison shows that the rise in credit risk is spread pretty evenly across the economy. With the exception of electricity, gas, steam & air conditioning supply as well as mining and quarrying, all sectors recorded an increase in the number of insolvencies in the Q4 2022 to Q3 2023 period, compared with 12 months earlier. For larger sectors (those accounting for at least 5% of insolvencies in England and Wales), rises ranged from 4% in professional, scientific & technical activities to a high 48% in accommodation and food service activities, a sector hit heavily by the cost of living crisis.

Looking ahead, insolvency risk is likely to remain elevated as the same factors that adversely impacted on companies in 2022-23 continue to bring pressure to bear. Although the cost of living crisis is gradually subsiding, pessimism in the British economy is widespread, growth is weak (if not negative) and interest rates will remain at their current level (the highest since 2008) until at least late 2024. Analysing counterparty risk frequently as well as potentially seeking insurance cover are advised against this high-risk backdrop.

Click here to visit our Whole Turnover Credit page for more information

Disclaimer

The information contained in these articles and documents are believed to be accurate at the time of date of issue, but no representation or warranty is given (express or implied) as to their accuracy, completeness or correctness. TMHCC accepts no liability whatsoever for any direct, indirect or consequential loss or damage arising in any way from any use of or reliance placed on this material for any purpose. The contents of these articles/documents are the copyright of Tokio Marine HCC. Nothing in these articles/documents constitutes advice, nor creates a contractual relationship.

Related links

https://www.gfk.com/press/Consumer-Confidence-falls-nine-points-in-October

https://www.pmi.spglobal.com/Public/Home/PressRelease/f3386a51b4b04628a7675e301195ace7

https://www.pmi.spglobal.com/Public/Home/PressRelease/293f3917029b44008d093c37e51c8eb9

https://www.pmi.spglobal.com/Public/Home/PressRelease/5865c3d8108e4fc3a599a130174a53e3

https://www.bbc.com/news/business-67370315

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/september2023

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/jobsandvacanciesintheuk/latest

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/employmentintheuk/latest#toc

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/averageweeklyearningsingreatbritain/november2023

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/september2023

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/averageweeklyearningsingreatbritain/november2023

https://www.fxempire.com/currencies/gbp-usd/forward-rates

https://cdn.informa.es/sites/5c1a2fd74c7cb3612da076ea/content_entry5c5021510fa1c000c25b51f0/6513ea92a3e36000e4075c24/files/Pagos_europaT22023_es.pdf?1695804050

https://www.gov.uk/government/statistics/company-insolvency-statistics-july-to-september-2023/commentary-company-insolvency-statistics-july-to-september-2023#company-insolvency-in-scotland